VICTORIA GEDDES, Executive Director.

The IPO window has unexpectedly opened after more than 18 months of subdued activity. Given the slowdown since February due to COVID-19 and the level of uncertainty surrounding the outlook for economic growth, no-one was banking on a quick return in 2020 to the levels of activity that the market had enjoyed prior to 2019 so this has caught everyone by surprise.

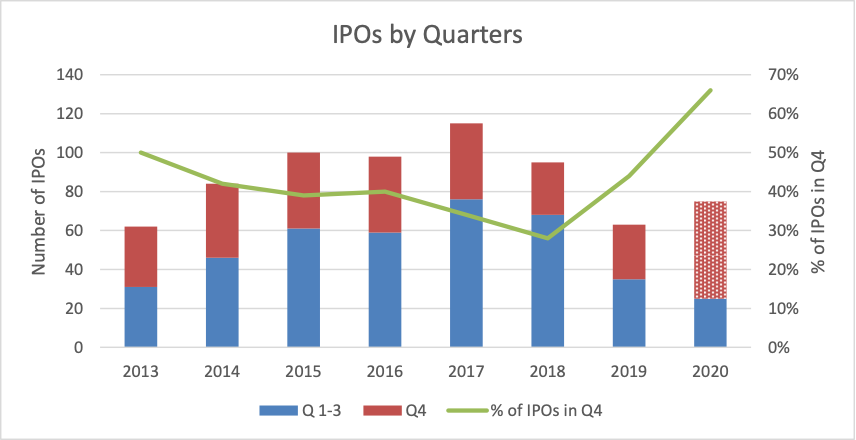

So what does a ‘normal’ IPO year look like? In 2019 there were only 63 IPOs which was 33% down on 2018, the last of a 4 year run of IPOs averaging 102 per year, peaking in 2017 at 115.

So far in 2020 there have been only 25 listings and half of those had a market cap less than $50 million. However the surprising development in the past couple of months has been the speed with which companies have accelerated their decision to list. Judging by ASX’ list of pending IPOs and conversations with brokers about their pipeline for the final quarter of 2020, there could be more than 50 come to market before year end which would result in the tally for 2020 approaching 75 with 66% in the final quarter. To put this into context, the highest number of listings in Q4 over the past decade has been 39 which was recorded every year from 2014 to 2017. In those years the percentage of IPOs in the fourth quarter ranged from 34% to 45%.

What is driving this push to list when the outlook appears so bleak? Much of it is momentum driven fuelled by a fear of missing out. With many investors and fund managers sitting on high levels of cash early in the year, those who held back in late March with the expectation that there would be another leg down have been scrambling to catch up by deploying capital into discounted capital raisings and new listings that might deliver some short term growth to lift their performance. In this context fund managers, regardless of whether they are value or growth oriented, are interested in any IPO that has a strong growth profile. In this environment growth is code for ‘tech’ so anything with a tech flavour to it will make the cut. Since April this year, 60% of listings have been technology based or utilise a technology driven solution, with applications encompassing the healthcare, finance, BNPL, media, information technology and industrial sectors.

The largest float to date has been Aroa Biosurgery ($402 million) and of those that are likely to list in Q4 and in the public domain, Brookfield’s $1.5bn+ Dalrymple Bay Coal Terminal looks set to win the accolade for the largest float in 2020 if it chooses the IPO route over trade sale.

The most active brokers bringing new listings to market appear to be Canaccord, Shaw, Morgans, Bell Potter and Macquarie. Realistically, there are only so many new listings that retail brokers can sell into their distribution networks before client fatigue sets in. Given the increasing level of volatility in the market, it is also highly likely that many of rumoured 50plus IPOs in the pipeline won’t make it through to the other end. Our sense, talking to a cross section of brokers, is that there is a high level of nervousness about the sustainability of this IPO market, so let’s enjoy it while we can.

Download our brochure IPO-Related Services