VICTORIA GEDDES, Executive Director.

Annual General Meeting season has just concluded and while the stats are still being collated for the final quarter, we already know that the role of climate and environmental activists in pursuing their agenda has continued to increase this year. Data collected by Insightia from Q1 to Q3 over the past four years (2018-2021), reveal that activist campaigns centred on climate change and GHG emissions, the E in ESG, have risen 150% (from 4 to 10). While Governance issues still have prominence, spilling into public demands through 13-14 campaigns a year (measured over the same period), they are not increasing. They are typically focused on amendments to company policy, requests for information to be disclosed or a change in board composition. Activism around Social issues in Australia is rare and when it does appear is usually focused on matters relating to human rights.

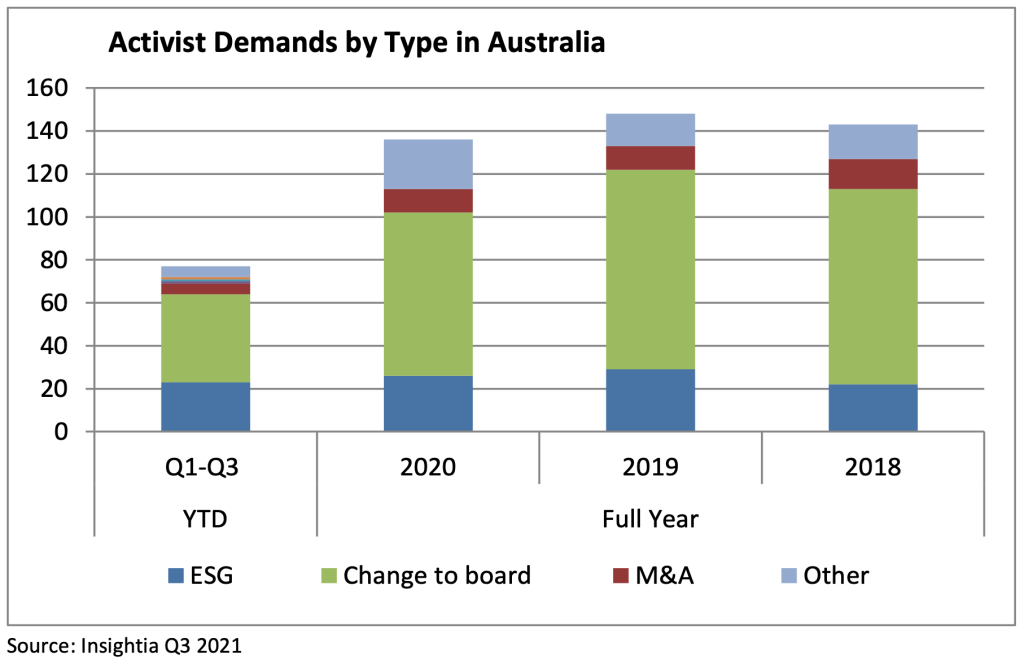

In Australia ESG activism has been, and continues to be, a subset of a much broader group of shareholder activist behaviour that saw a peak in activity during 2018 and 2019. COVID took some wind out activists’ sails in 2020, but the impact has been greater this year. In recent years ESG has accounted for 15-20% of all activism with the appointment or removal of directors dominating the space, accounting for two thirds of all demands. In 2020 and 2021 this dominance remains but has fallen to just over half while ESG demands in 2021 are shaping up to record their strongest year, accounting for over a third of all activism in Australia.

Tech stocks more active while nano/microcaps less dominant

While companies in the resources sector have continued to dominate the activist space in 2021 (43% of campaigns), followed some distance behind by financial services stocks (13%), technology stocks have almost doubled their representation (13%) compared to prior years.

Another trend worth noting is the shift from nano/microcaps being the dominant players (68-74%) over the past 3 years to mid/large caps increasing their presence from 13% in 2018 to 22% in 2020. So far this year companies with a market cap of less than $250m account for just over half (57%) of activism while companies valued at over $2bn represent 17%. This increase in activity amongst the mid to large cap stocks is driven by increasing demands from shareholders on ESG issues.

Activists gaining the upper hand

FIRST Advisers has been actively engaged in supporting clients through activist campaigns that involve the requisition of shareholder meetings for over a decade. These typically represent the preferred approach of around half of all activists and, compared to recent years, 2021 is emerging as the most subdued for many years. So far this year (to end November) only 14 companies have been targeted, three of them on two occasions. Our analysis of requisition notices lodged by activists reveals a 50% fall compared with 2020. More significantly activists have been successful in two thirds of campaigns, either by winning support from shareholders at the Meeting or achieving their outcomes prior to the meeting. In 2020 the success rate was split roughly 50:50 with 18 companies being targeted but half of those were requisitioned anywhere between two and four times during the year.

Trends in Activism Globally

Despite consistently being ranked second in the world on activism, Australia’s style and focus has always been very different to other countries with its heavy bias to microcap stocks in the resources sector. Nevertheless its decline in activism over the past two years is similar to that experienced in the US, Canada and to some extent the UK. Going against the trend are Japan, Germany and South Korea which have all experienced increases, particularly in the current year, with Japan overtaking Australia to rank second behind the US.

As 2021 comes to a close markets appear increasingly fragile as the outlook for inflation and uncertainties relating to the new Omicron strain of COVID weigh on the minds of investors. This together with the increasing focus on ESG means the opportunity for activism in 2022 is unlikely to diminish.