VICTORIA GEDDES, Executive Director

Activism during COVID

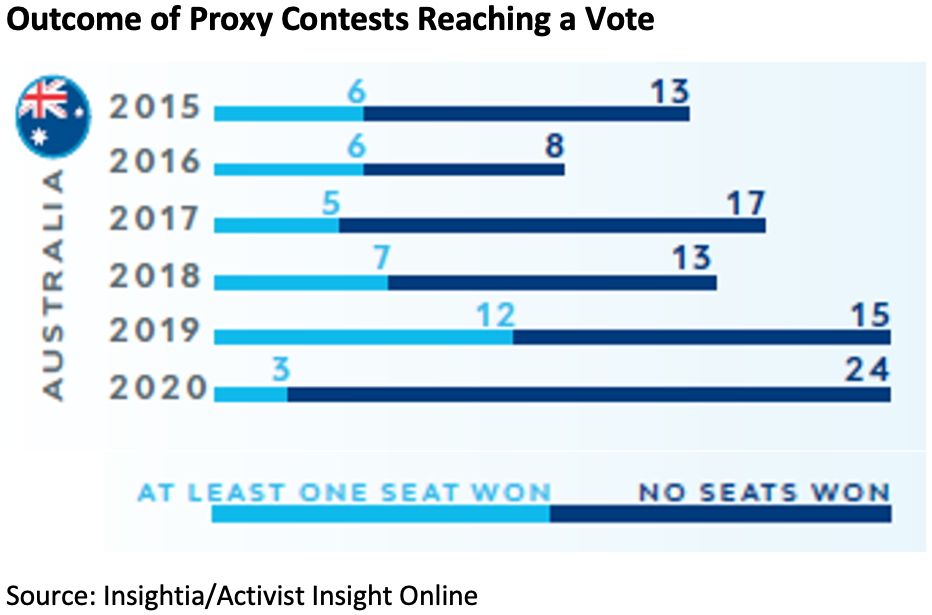

A review of the impact of COVID 19 on activism globally in 2020 would suggest that it largely reinforced the trend of slowing activity that has been evident since its peak in 2018. In Australia the number of companies publically subjected to activists’ demands returned to the annual average prior to 2018 of 66. However, not all demands actually make it to a meeting and in Australia shareholders would typically get to vote on around 20-30% of the total. In 2019 and 2020 this rose to 36% and 41% but what was very different last year was the significant drop in the success rate of activists in achieving their outcome. Only three campaigns out of 27 (11%) succeeded in winning at least one board seat compared with a 44% success rate in 2019 across the same number of campaigns. In 2021 the trend appears to have reverted to past patterns – there have been 13 campaigns in 1Q21 in Australia which is similar to the same period last year and of those only three (23%) have gone to a meeting with the activist succeeding in one (33%).

Australia vs. the rest of the world

So how different was Australia’s experience to the rest of the world last year? Most regions were marginally down, or up in the case of Japan, compared to prior years. The two outliers were Europe and Australia which both experienced a meaningful drop in the number of board seats won by activists. In 2020 there was a sharp decline in proxy contests that went to a vote at Europe-based companies which also experienced a big drop in activism generally – ten proxy contests, down from 27 the year before, with the U.K. experiencing the biggest decline.

The Influence of Index Funds and Proxy Advisors

Activism in Australia is largely played out amongst the micro and nano caps in the Materials sector, which means they are too small to attract the attention of proxy advisers or the global index funds. We have to look offshore to discern any trends in that direction that might be likely to impact the larger market cap stocks in the Australian market.

Activist Insight’s analysis noted that BlackRock delivered a sharp increase in backing for activists in 2020, supporting 25% of dissidents compared to 10% the previous year. At the same time Blackrock votes matching proxy adviser recommendations fell from 60% in 2019 to 50% in 2020. A similar trend was in evidence with both Vanguard and State Street Global Advisors whose votes were in line with proxy advisor recommendations in 60% of 2020 proxy contests compared to 80% in 2019. So there is a definite shift away from funds automatically following proxy advisor voting recommendations.

The Shift to ESG Activism

Activism to date has largely been financially driven with common issues being board related, M&A, strategy, governance, balance sheet or remuneration. Over the past 12-18 months ESG management has emerged as a more significant driver of shareholder dissent. Late last year the findings of a Schroders survey of 650 global investors on their attitudes to sustainability was released. It showed a dramatic rise in the proportion of investors who say they support active engagement with companies from 38% in 2019 to 59%. Active engagement covers both voting and discussion behind the scenes. This type of activism is in addition to grass roots, environmentally focused activist campaigners in Australia such as Market Forces or the Australasian Centre for Corporate Responsibility (ACCR).

Today even well-performing companies can face tough conversations. Some of the world’s largest asset managers announced in early 2020 that they would potentially vote against directors if they found companies’ management approaches to key ESG risks insufficient. This year, there is no question that a range of issues will feature high on investors’ agendas, from a company’s response to the pandemic, to concerns about human capital management and social inequalities, and a continued focus on climate change.

ESG and out performance

In Australia there is a growing awareness by companies that shareholders want to see that they are safeguarding shareholder value by protecting against risks associated with a wide range of environmental and social issues. In ASX’ 4th Edition of its Corporate Governance Principles and Guidelines, published in February 2019, the ASX Governance Council specifically noted that “How an entity manages environmental and social risks can affect its ability to create long term value for security holders. Accordingly, investors are calling for greater transparency on the environmental and social risks faced by listed entities, so that they can properly assess the risk of investing in those entities.” The reward for companies acting on this message is unambiguous – a strong ESG programme will help them rise above the noise in the competitive market for capital.

For investors the verdict is already in. As global equity markets plunged in March 2020 I drew attention in an article at the time to the conspicuous outperformance of funds during the downturn that had an ESG focus to their investments. This was once the exclusive domain of ‘ethical’ or ‘sustainable’ funds but has now gone mainstream. In the past 5-10 years the investment community has been the primary driver of this growing ESG consciousness. In order to measure their exposure they are demanding transparent reporting and as such reporting frameworks such as SASB, GRI and TCFD have become very relevant because they enable companies to report in a consistent, comparable manner.

Another important contributor to the trend is the fact that ESG is emerging as a driving force in asset flows, stewardship and increasingly activism. Activists offshore are beginning to add arguments about the management of material environmental and social issues to their criticism of company performance. Statements about human capital management and climate change are already starting to surface in campaigns and are viewed as the primary drivers for potential dissent in 2021. As a result being able to engage effectively on how ESG is tied into your business strategy will be absolutely critical for this year and beyond.