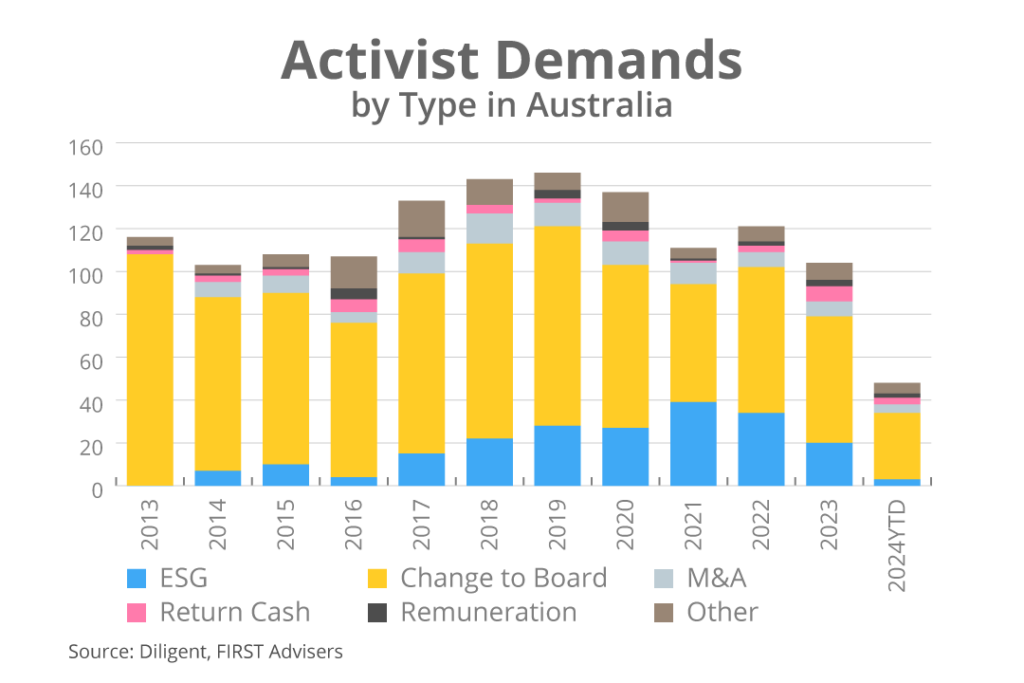

We have been tracking the evolution of activism in Australia for the past 10 years and it would be fair to say that in recent years there has been a high expectation that we would see an acceleration in ESG campaigns as Sustainability Reporting became increasingly mainstream. This has not proved to be the case and, despite a steady incremental increase from 2017-2021, ESG activism since has been falling.

The main game in Australia has always been to use activism as the weapon of choice when seeking changes to the Board. Since 2019, however, as the chart above highlights, ESG activism but also activism generally has been in decline, falling 29% over 4 years with the trend continuing in 2024.

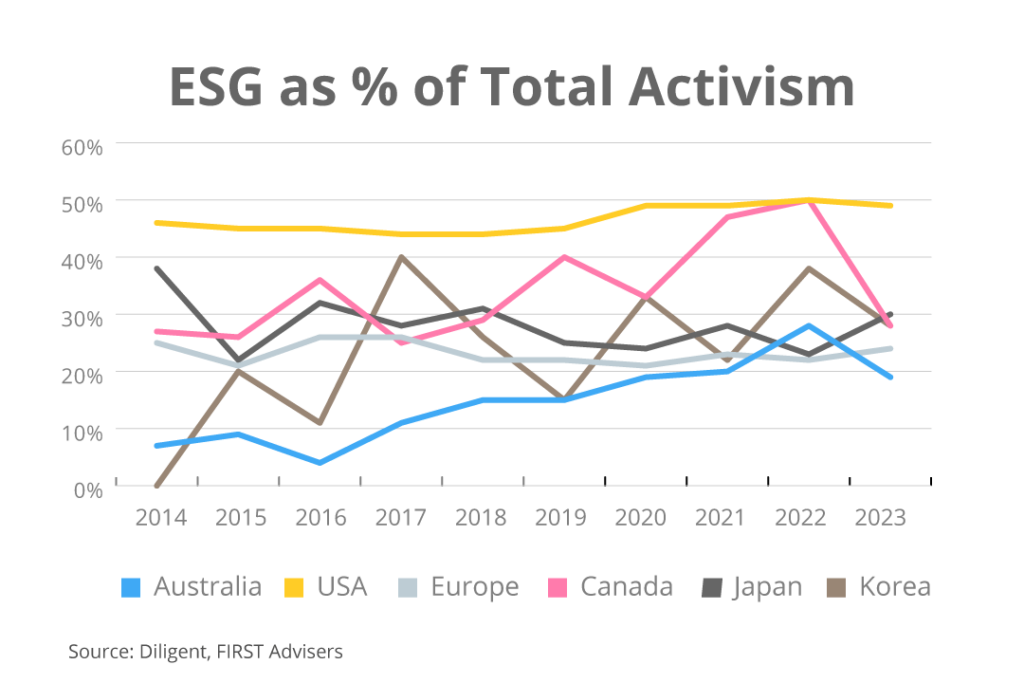

Australia’s ESG experience, when compared to the rest of the world, stands apart. Apart from 2022, it has reported the lowest proportion of activism in ESG, even in those years (2017–2022) when it was on a growth trajectory. ESG in the US (48%), Europe (22%) and Japan (25%) has remained at a consistent percentage of total activism over the past ten years while both Canada and Korea are growing but also highly volatile as the chart below shows.

Leaving aside the US, what we saw last year was a convergence of ESG as a percentage of total activism around 20-30% for all countries with Australia at 20%.

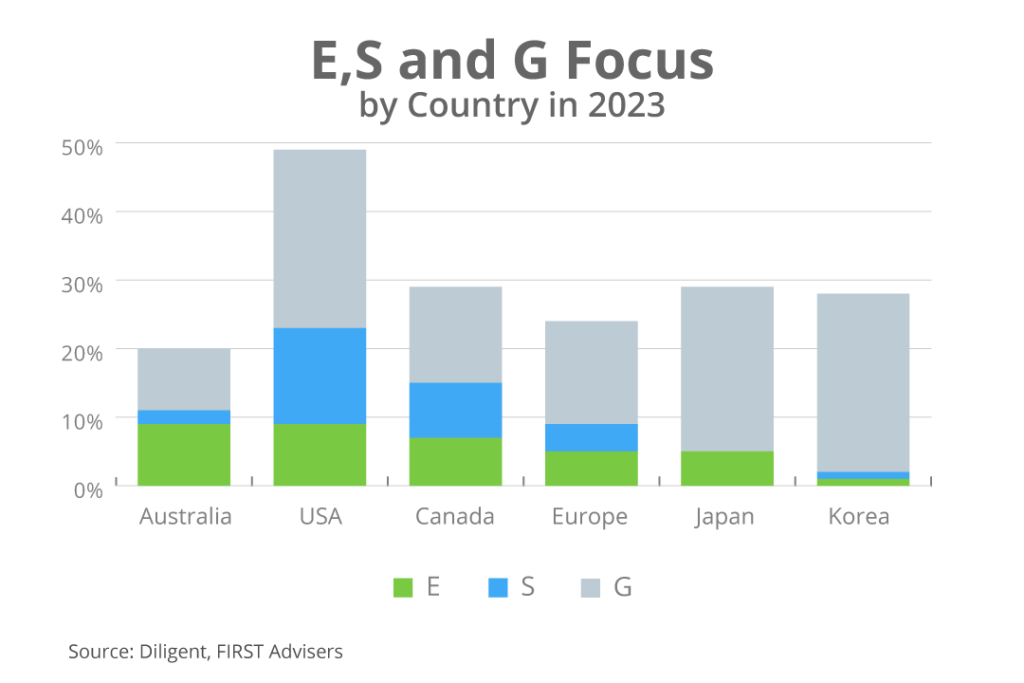

So if we break down ESG into its component parts, what can we say about the primary focus of ESG activism in Australia and is it any different to other countries where activism is popular?

In 2023 Governance was the clear leader, particularly in the US, Japan and Korea.

In Australia Governance and the Environment were of equal importance although the focus on Governance was the lowest of all countries/regions.

While Environmental activism in Australia was the highest, relative to other countries, it still represented only 9% of all activist campaigns with Europe, Japan and Korea showing the least interest.

Similarly, Socially oriented activism sits well below the radar for all with the exception of the US (14%) and Canada (8%).

While the data might provide some comfort to companies concerned that the level of ESG activism in Australia is poised to replicate that in the US, the fact remains that activism generally is ever present. FIRST Advisers has been providing specialist activism support to companies and activists since 2010 and while activity levels have retreated from the heady days of 2017-2020, there are still 70-90 campaigns a year that are not ESG related. These are focused on the more traditional Australian style of activism, including resolutions to change the board, M&A, remuneration, return of cash, divesture of assets and various operational demands. We will take a deeper look at how these play out in our next newsletter.