GILES RAFFERTY, Media and Financial PR

As we enter the October to November AGM season it is helpful to do a temperature check with the Proxy Advisor firms to get a sense of the issues they see as heating up and which are cooling down.

Proxy Advisor firms offer comprehensive analysis of resolutions and guidance on how to vote on AGM resolutions to investment managers and asset owners for each company in which they are invested.

Remuneration

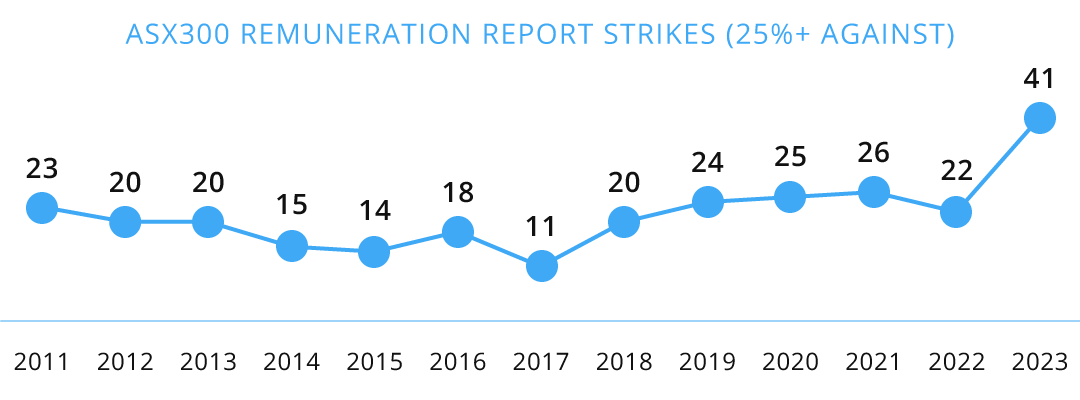

In 2023, the perennial hot topic issue of remuneration burned brightly, with a record 41 strikes against ASX300 companies’ remuneration reports, the highest since the introduction of the 2-strike rule in 2011.

Source: CGI Glass Lewis

Proxy Advisor, CGI Glass Lewis identified several factors that contributed to this spike in strikes against companies’ remuneration reports, including poor shareholder returns; performance issues; short-term remuneration structures that lack skin in game; headline risk and reputation issues and Shareholder activism

The team at CGI Glass Lewis is expecting the 2023 strike votes to prompt strike responses from the companies affected, an uptick in engagement by those companies with shareholders and in many cases changes to remuneration plans and structures, during the 2024 AGM season.

It is an expectation shared by Louise Davidson, CEO of the Australian Council of Superannuation Investors (ACSI), who said, “Last year’s AGM season saw a record number of votes against remuneration reports. We’ll be interested in how companies have responded to investor feedback, so remuneration and board accountability will be a big focus.”

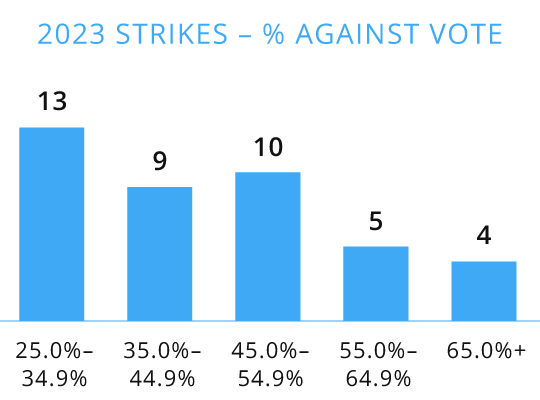

Another interesting trend revealed in data on strikes compiled by CGI Glass Lewis is an increase in the percentage of shareholders voting against remuneration reports in 2023. At least 9 of the 41 strikes last year, over 20% of them, involved the majority of shareholders voting against the remuneration report.

Source: CGI Glass Lewis

Philip Foo, VP of APAC Research at CGI Glass Lewis observed the greater willingness of shareholders to oppose a remuneration report is a shift in voting behaviour, saying “5 years ago seeing 30% against a remuneration report was considered a significant strike and seeing a majority against was almost unheard of. Last year there were plenty of strikes above 50%. So we’re seeing a lot of opposition from shareholders and some of it is extreme.”

Challenges to Directors

Another hot topic to watch for is protest votes against Directors. In 2023, there was a record level of opposition to Board endorsed nominees for the role of company director, with 25 resolutions being voted down. CGI Glass Lewis attributes this spike in protest votes against Directors to investors responding to poor returns and performance but also to an elevated level of Fund Manager activism. A similar level of Fund Manager activism has yet to emerge in 2024 but that is not to say it may not as the AGM season runs its course. So, alongside Rem Reports, poor governance and poor performance remain front of mind at CGI Glass Lewis.

Climate risks

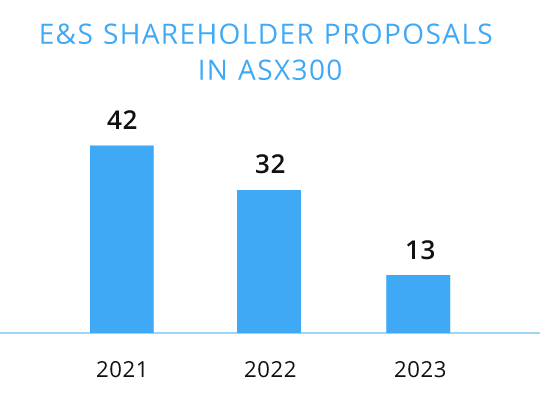

If strikes against Rem reports are running hot, activism around the Environment and Social components of ESG have cooled dramatically between 2021 and 2023.

Source: CGI Glass Lewis

There is still time for E&S activism to emerge in 2HY 2024 but looking at the E&S activism over the first halves of the current year and the two previous financial years reveals there were zero proposals in 1HY24 compared to 4 in 1HY23 and 10 in 1HY22. This decline in E&S shareholder proposals can, in part, be explained by a shift by environmental activist organisations Market Forces and the Australasian Centre for Corporate Responsibility (ACCR) to a strategy to issuing member’s statements advising Shareholders vote against company resolutions, rather than submitting their own and also a refocussing of their activity towards companies in other jurisdictions.

Philip Foo at CGI Glass Lewis, “The activists’ Australian strategy has moved toward lodging member’s statement to vote no on management resolutions as opposed to lodging shareholder resolutions. Market Forces and ACCR are also no longer soley focused on Australian entities as both now also frequently target companies in Japan with shareholder resolutions.”

In addition, several companies introduced a triennial Say on Climate vote in 2022, creating a mechanism for shareholders to opine on a company’s performance as it relates to climate change and emissions without the need for a shareholder resolution. Consequently 2024 may well be a quieter year for E&S activism, but shareholders remain active. In the coming AGM season biodiversity has emerged as an area of focus with shareholder resolutions expected at Woolworths’ and Coles’ AGMs around sourcing Tasmanian farmed salmon from areas where the farming activity is putting other species at risk of extinction.

Lousie Davidson, CEO at ACSI, “Climate will be a focus, with BHP offering investors a second say on climate vote. Biodiversity-related shareholder proposals are also making an appearance at Woolworths and Coles, showing investors’ growing interest in the way companies are managing nature and biodiversity-related risks.”

Mandatory climate-related financial disclosures

The introduction of new climate-related disclosure requirements in Australia from 2025 may also be contributing to a hiatus in shareholder action to address the impacts of listed companies on climate change.

The introduction of this mandatory climate reporting regime is staggered, with the big end of town required to report from 2025 onwards, followed by mid-caps in 2026 and the small caps in 2027.

The expectation is companies are making preparations for mandatory climate reporting during FY2024 ahead of reporting in 2025, after which shareholders will be able to make an informed decision on the need for additional action on climate change.

The hope is the requirement for mandating climate reporting will help make the disclosures by the companies that already report on their management of climate risks more comprehensible and comparable, while also providing clearer guidance for new reporters.

Lousie Davidson, CEO at ACSI, “Investors, companies and the broader market have a clear role in decarbonisation, and we hope mandatory reporting will drive transparency and lift the standards and content across the market.”

Supporting companies with ESG reporting has grown to be an integral part of FIRST Advisers services over the past 5 years. In 2024, we are introducing additional support to help companies measure and reduce carbon emissions. Contact us at admin@firstadvisers.com.au.