GILES RAFFERTY, Corporate Communications and Media

Pass-through proxy voting gives investors of index and other passively managed funds the opportunity to vote the shares they hold at company meetings. Until recently, the fund manager would vote on behalf of their underlying investors in accordance with the voting guidelines for the fund they managed. The ability to offer pass-through voting is being enabled by advances in AI technology. This is streamlining the process for identifying who has the right to vote and how to capture and communicate that voting intention.

Pass-through voting is being initiated, in various formats, by the ‘Big Three’ global passive fund managers, BlackRock, Vanguard and State Street Global Advisors (“State Street”), in part to address criticism they wield too much voting power. This criticism includes suggestions the Big Three’s stewardship teams are voting in a manner designed to make the fund appealing to millennial investors, rather than promote good governance. This argument is well expressed by Bernard Sharman, a senior corporate governance fellow at RealClearFoundation , in his paper “Opportunism in the Shareholder Voting and Engagement of the ‘Big Three’ Investment Advisors to Index Funds”published in early January 2022.

I think the world of Larry Fink, but I’m not sure I want him to be my emperor.”

Charlie Munger, vice Chairman, Berkshire Hathaway

In February 2022, Charlie Munger, the vice Chairman of Warren Buffet’s Berkshire Hathaway described the ‘Big Three’ as “a new bunch of emperors” while addressing the Daily Journal Corp AGM about the growing power of passive funds because of the large stakes they hold in a majority of US companies. Mr. Munger is the chair of the Daily Journal Corp.

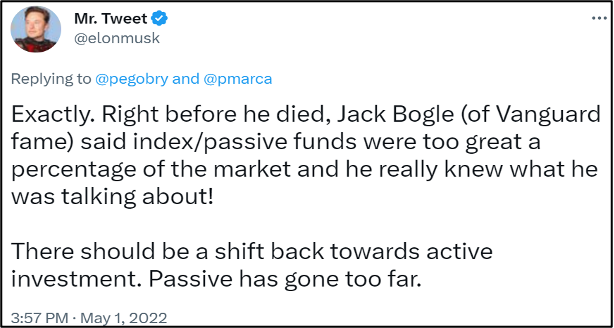

The ever colourful Elon Musk has also chimed in on the subject. Back in May of 2022, Mr. Musk in reply to a tweet bemoaning the role of investment managers, observed “…decisions are being made on behalf of actual shareholders that are contrary to their interests. Major problem with passive/index funds!”

Twitter was also the platform of choice for high profile US senator, Bernie Sanders, to comment in July 2022 that it was obscene for just three wall street firms, BlackRock, Vanguard and State Street, to be major shareholders in more than 96% of S&P 500 companies.

For their part, BlackRock, Vanguard and State Street have started taking steps to address these criticisms by offering various versions of pass-through voting. BlackRock was first out of the gates in October 2021 with the launch of its Voting Choice technology to allow some institutional investors the opportunity to directly vote their shares in BlackRock funds. Voting choice was expanded to cover a larger portion of BlackRock clients, up to 47%, in June 2022 and again with a focus on retail clients in November 2022, a year after its launch.

Vanguard announced a pilot scheme to offer proxy voting options for individual investors across several Vanguard-managed equity index funds in November 2022. State Steet joined this proxy voting arms race in December 2022, announcing it will offer more investors the power to direct how shares held in the funds they own are voted.

While this democratization of proxy voting may, in time, help mitigate the concentration of voting power with the ‘Big Three’, it also presents some new challenges to Investor Relations teams. As individual investors become empowered to cast their votes, IROs may need to find ways to directly engage with their underlying investors.

Another consideration for IROs will be ensuring that they brief proxy advisory firms. Initial Voting Choice data from BlackRock, in June 2022, indicated the most popular option amongst clients for expressing their voting preferences is to select from a menu of third party Proxy Advisor voting policies. Should this trend continue, Proxy Advisory firms are likely to become more influential.

The trend to devolving voting power to retail investors may create opportunities for activists to corral new voters to influence the outcomes of proxy campaigns. There is also a risk of fake news being promoted to newly empowered retail investors in an attempt to influence their voting decisions. In these circumstances, it will be critical that Investor Relations teams can effectively communicate accurate company information.

There is still much to be done before pass-through voting is fully implemented by the Big Three, let alone the wider fund management industry. It will take time for the full impact of this democratization of shareholder voting to be revealed, however, it seems likely the ability to directly engage with the beneficial holders of a company’s securities will only grow in importance. This makes FIRST Advisers’ established shareholder solicitation expertise a vital tool for IROs.