Ben Rebbeck, Executive Director

As we enter the 2018 results reporting season, earnings and operational guidance again becomes a topic of significant concern.

Recently in the US, industry leaders including Warren Buffett and Jamie Dimon joined the debate arguing that public companies should reduce or eliminate the practice of estimating quarterly earnings (EPS), as this created short-termism that harms both their companies and the economy.

Given their leading identities, their entrance into the debate has driven valuable discussion and analysis over the use and impact of earnings guidance. In this article, I focus on some of the key issues raised in this debate and the context in which arguments are raised.

The US context.

Companies in the US are locked into a quarterly reporting regime, unlike Australia’s half yearly reporting timetable. As a result guidance for the next period can, and should be measurably more accurate.

Clearly, with reporting occurring 6 weeks into a 12 week cycle – and with the Quarter’s expenses mostly known and sales orders locked in – management’s confidence in the Quarter’s earnings should be very high. Consequently, as the margin for error is seen to be very small, the market reaction to missing EPS guidance (down or up) can be severe…. Does management not know what’s going on? The change really must have been a surprise?

This is clearly a very different context to guidance in Australia, which is mostly given on an annual basis – where a lot of unknowns remain ‘in play’.

Is there merit to their argument?

In their attention grabbing June article, Buffet and Dimon argued:

“In our experience, quarterly earnings guidance often leads to an unhealthy focus on short-term profits at the expense of long-term strategy, growth and sustainability.”

In 2016 the McKinsey Quarterly Survey of CFOs (?) found that 55% of US CFO’s would delay an NPV positive project to hit a quarterly earnings target. Similarly, an analysis by FCLT Global found executives would take the following short term actions to meet quarterly guidance:

-

- 60% would delay projects;

- 80% would cut discretionary spending; and

- 40% would give discounts to customers.

While delaying expenditure a couple of weeks, or providing short term customer discounts, might not seem too bad an option in the face of a severe market reaction to missing guidance, over the long term one would expect that a company should make decisions in the most appropriate manner to maximise shareholder value.

Indeed, the McKinsey survey found that 86% of executives agree that longer time horizons for business decisions would improve performance.

But what is often lost in the headlines and by-lines of an article is the nuance of any argument. In this regard, Buffet and Dimon continued to offer their support for guidance for longer time framed financials (e.g. annual EPS guidance) and around operations and strategy…

“Clear communication of a company’s strategic goals—along with metrics that can be evaluated over time—will always be critical to shareholders. But this information, which may include nonfinancial operational performance, should be provided on a timeline deemed appropriate for the needs of each specific company and its investors, whether annual or otherwise.”

But what do shareholders want?

What is clear both in the US and globally is that the buy-side is not demanding companies provide short term guidance. Notably, different pressures may emerge from the sell-side who are often benchmarked on the accuracy of their short term financial models.

Evidencing this point, a 2016 study conducted by Rivel Research Group (Attitudes and Practices of the Global Buy-Side), found that a mere 7% of the global buy-side want companies to offer guidance on any metric for periods of less than one year.

Similarly studies by the CFA Institute in 2006 found 76% of global analysts think companies should move away from quarterly earnings guidance; and an Edelmen survey in 2017 found 86% of investors agree that focussing on short term results does not benefit their investment strategies.

And what do US Corporates do?

While the statistics around what executives would do to meet quarterly guidance are particularly damning, it’s useful to reflect on what guidance US corporates are currently providing.

In 2017, Rivel Research analysed guidance provide by US companies. This research found that only 23% of US corporates were providing EPS guidance over a period of less than 1 year; two-thirds were providing annual guidance; and 10% were providing longer term guidance.

Notably, this guidance timeframe matched almost perfectly with the expectations of the institutional investors in the companies analysed.

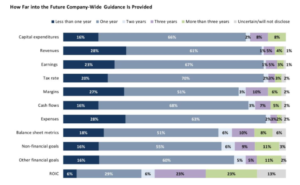

Indeed, the analysis found the overwhelming majority of US corporates already provide financial and non-financial guidance across a broad range of measures over medium and long time frames.

In Australia, First Advisers’ 2017 Guidance Research came to a similar conclusion for the local market. Namely that investors are often best served when companies focus their forward looking disclosure on the business’ strategy and key value drivers. It was also clear that different approaches to guidance are valid for different industries, or indeed different companies within the same industry at different points in their lifecycle.

Storm in a teacup?

Taking into account potential for US corporate behaviour to meet very short term guidance numbers, it can be seen as entirely reasonable to shift the current focus on quarterly guidance to annual financial, operational and strategic measures. In many respects, this already reflects the current behaviour of the majority of US companies and their investors.

From an Australian perspective our own research suggests that ‘annual guidance with commentary around operations and strategy’ is exactly what companies already provide the Australian market. So there is little evidence that any change to guidance behaviour is warranted.

We will be updating our Guidance Research for the FY18 reporting season over the next month and publishing the results in our next newsletter.

For now, as prominent AFL Umpire, ‘Razor’ Ray Chamberlain would say, “Play-on!”