ROWAN CLARKE, Investor Relations

With the 2022 reporting season behind us, many companies have shifted their attention to planning the Annual General Meeting (AGM). One piece of the meeting that all companies need to navigate is securing the requisite 75% of shareholder votes for the Remuneration Report.

Voting on the Remuneration Report is watched closely because of the ‘two-strikes rule.’ If 25% or more of the votes cast at an AGM are against the Remuneration Report a company is said to have had a ‘strike’ against the report. If there is a strike against a company’s remuneration report over two consecutive years a resolution to ‘spill the Board’ must be put to shareholders. A successful spill resolution would trigger a ‘spill meeting’ where the company’s directors would be required to stand for re-election. Failure to adopt the Remuneration Report over two consecutive years has the potential to significantly disrupt the leadership of a company. Since 2011 when the rule was first introduced there has yet to be a successful spill resolution, suggesting that the steps taken in the year following the first strike were sufficient to avoid a second.

In this blog, we review trends that we have observed in 2021 and outline ways to mitigate the risk of a ‘strike.’

Use of the ‘Two-Strike Rule’ rose in 2021

Research shows that there was an increase in the number of companies on the ASX200 receiving a strike against their Remuneration Report in 2021. 10.63% received a strike in 2021 compared with 8.18% in 2020. The increase in number of companies receiving a strike was most pronounced among the largest 100 companies, where 11.11% received a strike compared to 7.32% the previous year.

| 2021A | 2020B | |

| ASX100 | ||

| Receiving a strike | 11.11% (9) | 7.32% (6) |

| Average % vote ‘Against’ Rem report | 8.50% | 9.29% |

| ASX200 | ||

| Receiving a strike | 10.63% (17) | 8.18% (13) |

| Average % vote ‘Against’ Rem report | 8.63% | 8.70% |

A 81 companies on the ASX100, and 160 companies on the ASX200 in 2021, after removing REITs and foreign domiciled companies

B 82 companies on the ASX100, and 159 companies on the ASX200 in 2020, after removing REITs and foreign domiciled companies

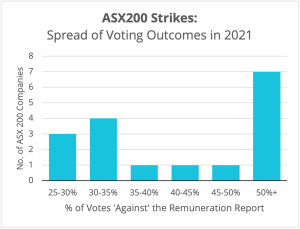

The chart provides an overview of the spread of votes against the Remuneration Report in 2021. A key feature is the number of ‘extreme’ votes, with seven companies receiving a vote against the Remuneration Report in excess of 50% in 2021. Those companies were Dexus (66%), Link Administration (63%), Rio Tinto (61%), Insurance Australia Group (57%), Whitehaven Coal (53%), Scentre Group (51%), and Platinum Investment Management (50%).

The chart provides an overview of the spread of votes against the Remuneration Report in 2021. A key feature is the number of ‘extreme’ votes, with seven companies receiving a vote against the Remuneration Report in excess of 50% in 2021. Those companies were Dexus (66%), Link Administration (63%), Rio Tinto (61%), Insurance Australia Group (57%), Whitehaven Coal (53%), Scentre Group (51%), and Platinum Investment Management (50%).

Crown Resorts was the only company to receive a second strike in 2021. Despite this, the subsequent spill motion did not pass as many of the Board members had resigned prior to the AGM.

Managing the ‘Two-Strike Rule’

Key to mitigating the risk of a ‘strike’ is understanding why shareholders vote against the Remuneration Report and making sure that Boards engage with the correct people before the AGM.

It is most commonly the case that companies are penalized on Remuneration Reports when they face broader challenges like compliance and environmental issues, questionable transactions, and public scrutiny on governance issues. In situations where shareholders perceive there to be a misalignment between executive pay and company performance, as well as when a strong protest vote is being registered, support for the Remuneration Report suffers. For example, Rio Tinto’s outcome in 2021 was driven by events at Juukan Gorge, while Westpac faced a second strike in 2021 due to criticism off the back of excessive write-downs, a string of regulatory lawsuits and fraud allegations.

FIRST Advisers can provide a comprehensive analysis of a company’s share register to identify those beneficial holders who exercise control over the voting decision at the Meeting. It is often the case that it is not the fund manager who manages the investment but the superfund so this allows companies to engage with the right people before the AGM. Engaging with shareholders about their concerns is a critical first step towards gaining their support. In addition, vote tracking allows companies to monitor votes as they are received by custodians, providing them with an opportunity to continue engaging with shareholders who vote ‘against’ before proxies close.