BEN REBBECK, Executive Director

The ascendency of ESG matters within Fund managers, Board rooms and with IROs has unquestionably been rising rapidly in recent years.

In this context, a question we often address from Directors and IRO is: Are ESG funds just another short term market trend, like ‘Hedge Funds’ were some 5 to 10 years ago, or are they here to stay?

ESG growth driven by both changes in market structure and investor awareness

ESG style investing has been on the radar for decades now, sometimes known as SRI or CSR investing. However, it has only been in the last 5 years that ESG investing has taken root and become a noticeable driver of institutional investment and investor behaviour.

As we reported last month, in our ‘Are traditional active managers facing extinction?’ blog, this trend has been driven by the increasing ownership of passive funds, who focus on drivers of long term value creation rather than short term financial performance, and asset owners, such as large pension and super funds, being more mindful of the impacts of ESG matters on both financial performance and on their own unitholders’ daily lives.

Demand driven from the latter of these, unitholder awareness, has seen a slew of active and passive ESG Funds being launched recently.

For example, this week, when global investor DWS Group (who has over EUR700bn under management) launched the U.S. Market’s first S&P 500 ESG ETF, its Head of Index Investing for the Americas, Luke Oliver, talked directly of the influence of unitholder social preferences, “Our clients seek solutions that not only deliver on their investment strategy, but also help them achieve their sustainability goals.”

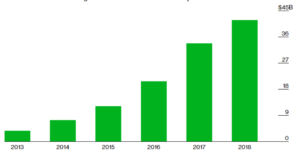

In June this year, UBS Wealth Management Americas’ top strategist for sustainable and impact investing, Andrew Lee, estimated that 12% of U.S. investors own sustainable investments. Further, UBS expects adoption to increase by 58% within five years. This trend is particularly evident with ESG focussed Exchange Traded Funds (ETFs) which, according to Bloomberg, had assets under management of a record US$41.6 billion last year.

Adding to this approximately 47% of global institutional investors place a material weight on ESG factors when making investment decisions, as covered in our ‘ESG is mainstream on main street’ blog.

Total Assets under management of ESG Exchange Traded Funds

Source: Bloomberg

In Australia, this trend is already well advanced. Global Sustainable Investment Alliance , a group of organisations tracking sustainable investing in five regions from the U.S. to Australia, estimate that approximately 63% of the value of institutional funds in Australia and New Zealand consider use ESG matters as part of their investment decision making.

We note that in coming to this Australian estimate the GSIA has a broad definition of ESG investing, counting any fund that uses a strategy associated with sustainability, whether it be negative or exclusionary screening; those that buy assets on certain ESG rulesor even funds that actively engage corporate boards on ESG matters.

Fad or Trend?

Notwithstanding this muddy definition, UBS’ Andrew Lee argues that unlike the trend to Hedge Funds, ESG Funds are here to stay.

Lee argues the key driver of this is ESG Fund performance, “A number of academic studies show a tie between corporations performing better from an environmental, social, and governance, or ESG, perspective and how that relates to financial performance.”

As examples, a recent analysis by US based Barron’s found that the performance of the most sustainable funds beat the broad market in each of 2016, 2017 and 2018. This compares to hedge funds whichhave underperformed over the past few years. And the MSCI All-Country World ESG Leaders index has outpaced its non-ESG counterpart over the past decade.

This dynamic creates an attractive influence for active fund managers globally, who are struggling to attract funds flows versus low cost passive funds, to create ESG products.

While ESG has gone mainstream in the institutional asset-management world it has significant opportunity to expand in the “retail” fund industry. Mutual and exchange-traded funds that reference ESG in their prospectus documents held just US$161 billion in assets at the end of 2018, according to Morningstar, compared to US$22.1 trillion in total U.S. fund assets.

On the outlook for funds flows, Lee noted “our expectation is that [ESG investment] growth off these lower levels will be higher in the U.S. and Asia versus Europe. On a go-forward basis, we think there is significant opportunity.”

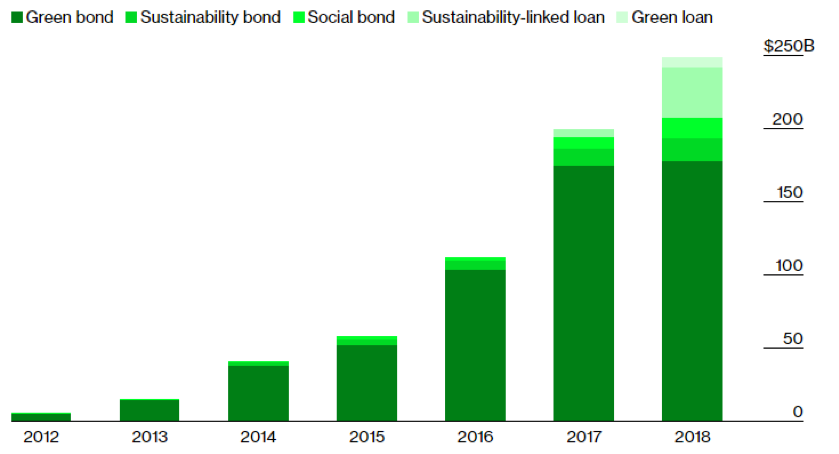

And it’s not just equities that is seeing significant new investment flows. BloombergNEF data shows that the global market for “green” bonds and loans that barely existed a few years ago, is worth almost US$250 billion today.

‘Sustainable’ debt issuance by instrument type

Source: BloombergNEF

All of this is feeding a “virtuous cycle of demand” for ESG products, Goldman Sachs wrote in a recent report. To stay competitive, asset managers must look like good corporate citizens, and by extension, so too their investee companies.