Victoria Geddes, Executive Director

It’s that time of year when listed companies around Australia are gearing up for results reporting season – finalising accounts, booking conference calls and webcasts, updating their list of beneficial owners to ensure they have identified all key decision-makers and starting to work on the key messages they want to deliver. They are also planning their post results roadshow.

While shareholders (read fund managers and asset owners) and brokers are typically the primary focus of results roadshows, this is also one of two dedicated periods in the financial year when companies also meet with potential investors. The way in which these introductions are made is evolving rapidly as big data becomes increasingly powerful and the old model of brokers acting as the intermediary is under challenge.

So how do you target new investors and is this just a new name for corporate access?

Corporate Access is, as the name implies, about providing investors with access to companies. Many brokers and investment banks have ‘corporate access teams’ which exist primarily to provide their clients with access to company management but also to foster the relationship with the company. From the company’s point of view this achieves the aim of gaining access to potential investors and, best of all, the only cost to them is their time. Corporate access to international investors or global ‘non deal’ roadshows over the last 10 years took this service to a new level with brokers organising all the logistics associated with travel and meeting schedules. Companies can provide the list of targets they wish to meet or leave it to the broker to identify. The better corporate access teams will conduct a targeting program,ensuring they include fund managers outside their own client base. For the effort involved, this level of service is largely confined to mega and large cap companies.

The introduction of MiFID II in Europe is widely expected to create a ripple effect globally around the issue of Corporate Access. Under the new rules which came into effect on 1 January 2018, Corporate Access as well as research must be paid for by the fund managers who benefit from it. They must set a budget for it and payment must come out of the fund manager’s P&L not the funds they manage.

While nothing has changed from the company’s perspective, the reality is that brokers who offer this service will only be able to go to clients who have a budget for it. This immediately narrows the universe of potential investors that can be targeted, compromising the value offering they are able to provide. It will also create a two tier market where large cap companies will continue to be serviced by the tier 1 brokers and investment banks while small and mid cap companies will increasingly be left to their own devices.

Over the past few years alternative corporate access providers have emerged in response to this looming disconnect by using technology to provide an online portal where investors can register their interest in meeting with a particular corporate. Investor relations firms that were once the go to providers of this service for companies, before brokers took it over, will find themselves in demand again as companies start looking to increase their IR budgets to support more internal and/or external resources.

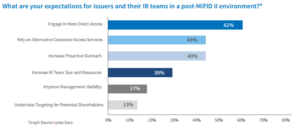

IPREO’s survey of companies, banks and institutions in July 2017 regarding their expectations for IR post MiFID II highlighted that companies expect to be much more involved in organising their own meetings with institutions. Alternative Corporate Access providers will be engaged and companies will become more proactive in identifying who they meet with.

Targeting new investors who could be potential shareholders is the ultimate objective of corporate access. Companies know who their shareholders are but they also need to be constantly building a bank of informed investors to supplement or replace current shareholders. Only a small proportion of the hundreds of thousands of funds have the right profile and investment style to match the investment proposition offered by a particular corporate.

So how do you identify new investors?

FIRST Advisers’ approach is to first analyse which investors are invested in a company’s peers but not in them. These are high quality targets as they have already identified themselves as interested in the sector so there is a potential switching opportunity. We analyse peer company registers of relevant interest and quickly build a comprehensive, validated list of targets for a company to approach.

Desk top targeting using powerful databases like Factset and Bloomberg also enables IROs to filter out fund managers in specific regions with appropriate investment styles to come up with a list that can then be further interrogated via research and direct email. While this process can be time consuming it ultimately saves time and money on wasted meetings. IR consultants and other corporate access specialists will often have extensive in-house knowledge from the work they do with a wide variety of corporates of how and where institutions like to invest and are keen to share this with their clients.

It is revealing that the buyside don’t hold great expectations that companies will undertake investor targeting (13%) but do expect a lot more activity in the form of proactive outreach, direct access, more use of alternative corporate access services and more resourcing of IR. The question then is how effective all that activity will be?