VICTORIA GEDDES, EXECUTIVE DIRECTOR

During the profit reporting season for the period ending 30 June 2017, we monitored all the companies in the S&P/ASX 300 that reported up to 31 August, building a picture of what the favoured approach to guidance is in this market and what that guidance is telling us about the outlook for FY2018. Some of the results surprised us.

The majority of companies provide guidance (87%)

Whether quantitative or qualitative, the majority of companies provide some form of guidance when reporting to the market. Of the 260 companies that reported during this period, 87% offered a view on the outlook. Interestingly though, this is at the low end of the range reported by a similar survey of US companies conducted by the National Investor Relations Institute (NIRI). Since 2010, 88-94% of US companies provided some form of guidance, biased to the higher end over the last 3 years.

Just under half of the companies expect an improved outlook in FY2018

93% of the Australian companies providing guidance expect FY2018 will deliver results that are the same as or better than FY2017, with a marginal bias in favour of the status quo.

The sectors that are most optimistic, with over 50% of companies expecting a better year in FY2018, are Materials (57%), Energy (55%), Information Technology (54%) and Consumer Discretionary (52%).

Sectors which are predominantly guiding for a similar year to FY2017, with more than 50% of companies expecting stability in results, include Utilities (67%), Industrials (60%), Financials (59%), Real Estate (58%) and Telecommunications (57%).

For companies in the Consumer Staples and Healthcare sectors the outlook appears to be less sector driven and more dependent on individual company circumstances.

Without exception, all the utilities, telecoms and information technology stocks provided steady or improved profit guidance for FY2018.

Excluding companies in the two consumer oriented sectors, no sector had more than one or two companies guiding FY2018 to be down on FY2017.

The overwhelming majority of companies chose to provide financial guidance (92%)

This outcome is very similar to the US experience where 91% of the 360 companies surveyed provided either financial only or a combination of financial and qualitative guidance.

The remaining 8% of companies in Australia and 9% in the US offer only qualitative guidance for the coming year.

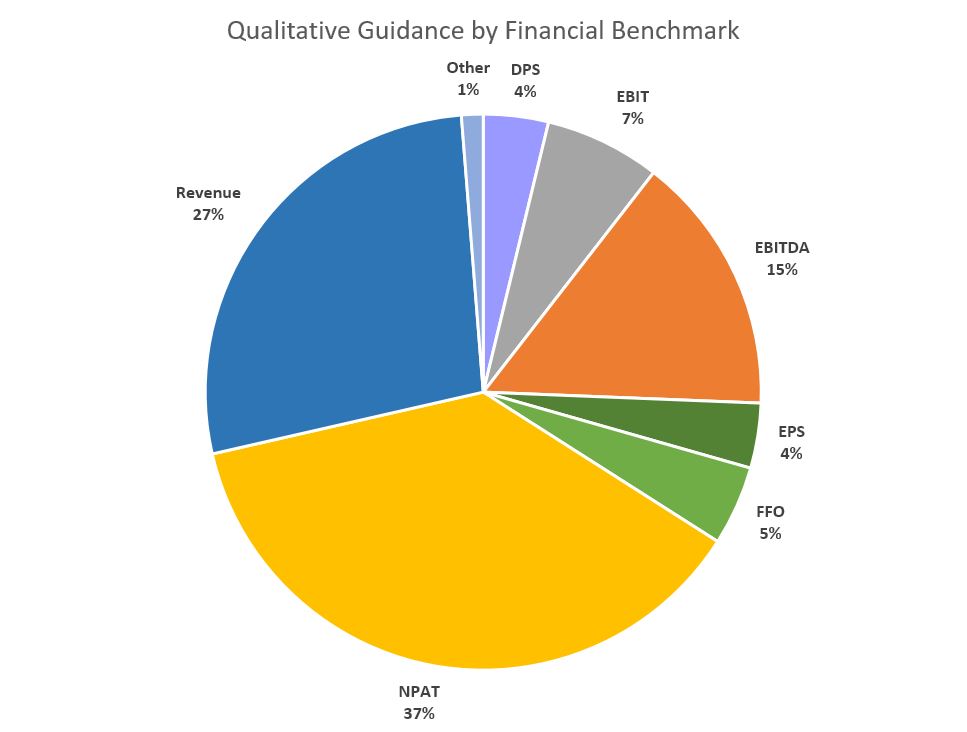

NPAT or Revenue dominate guidance

Net Profit after Tax was the most popular financial metric used for guidance (37%), followed by revenue (27%) and EBITDA (15%).

By contrast, in the US the top five financial guidance metrics are revenue, tax rate, capital expenditure, earnings or EPS and Operating expenses or margins.

The choice of financial metric by Australian companies also tended to vary according to sector:

-

- NPAT was most favoured by companies in the financials (56%), utilities (50%), materials (49%) and healthcare (48%) sectors.

- Revenue was more popular with companies in the information technology (60%) and consumer staples (40%) sectors.

- EBITDA and NPAT were equally favoured in the energy sector

Qualitative guidance could be more imaginative

For the 8% of companies that chose to limit their guidance to general qualitative statements, most were succinct in their commentary, providing only a general overall description of what to expect in FY2018. This was typically that FY2018 results would be either in line with FY2017 results or that the company would experience growth.

Some sectors focused on different aspects of their business or pointed to particular financial metrics when talking about the outlook.

-

- Companies in the materials sector, for example were more inclined to provide qualitative guidance relating to production growth

-

- “BDR anticipates production to be significantly higher in the next 12 months as grade increases with depth in the Tap AB complex.”

-

- A majority of companies in the consumer discretionary, consumer staples or energy sector referred in general terms to strengthening of the balance sheet and operational growth.

-

- “SGR will continue to focus on executing its strategy of pursuing capital expansion opportunities while improving operational results.”

-

- “Despite the constrained resource price environment, WOR is beginning to see increased activity in its energy and resources customers and predicts benefits of the overhead savings achieved in FY2017 will be reflected in FY2018. Worley Parsons also expects its balance sheet metrics to continue to improve.”

-

- “WOW expects to see a positive customer response to lower prices, better product solutions and a better customer shopping experience, it is still too soon to tell when this will translate into sales momentum and improved profitability. Woolworths also does not expect sales growth to continue at the same rate as achieved in Q4’17. “

There are many ways to provide qualitative guidance that can help investors understand the nature of the operating environment or market conditions that the company is facing. Market growth, industry specific information, trend data that is relevant to parts of the company’s business are all examples of how a company can talk to outlook in a way that adds value and fosters a sense of transparency.