ROWAN CLARKE, Investor Relations

At FIRST Advisers, a number of our clients are starting to focus on the task of reporting on their Environmental, Social and Governance (ESG) performance for the first time. This reflects the increased momentum that has been gathering in recent years, particularly in the ASX 300. We first undertook a review of ESG disclosure practices in October 2020, using data collected in 2019. This analysis provides an update on the state of play in 2021 and what has changed since our last review.

Our review is focused on companies in the S&P/ASX300, segmented by market cap into Large-Cap (the S&P/ASX100), Mid-Cap (the S&P/ASX200 less 100), and Small-Cap companies (the S&P/ASX300 less 200). We also provide our first assessment on ESG Reporting in New Zealand, including the 20 companies comprising the S&P/NZX20.

Unlike financial data, the reporting of ESG performance is not mandatory. Companies can choose how they wish to provide this information and will typically adopt one or more of three approaches – a standalone ESG report, ESG disclosure within the annual report, and/or provide a section dedicated to ESG on the company’s website.

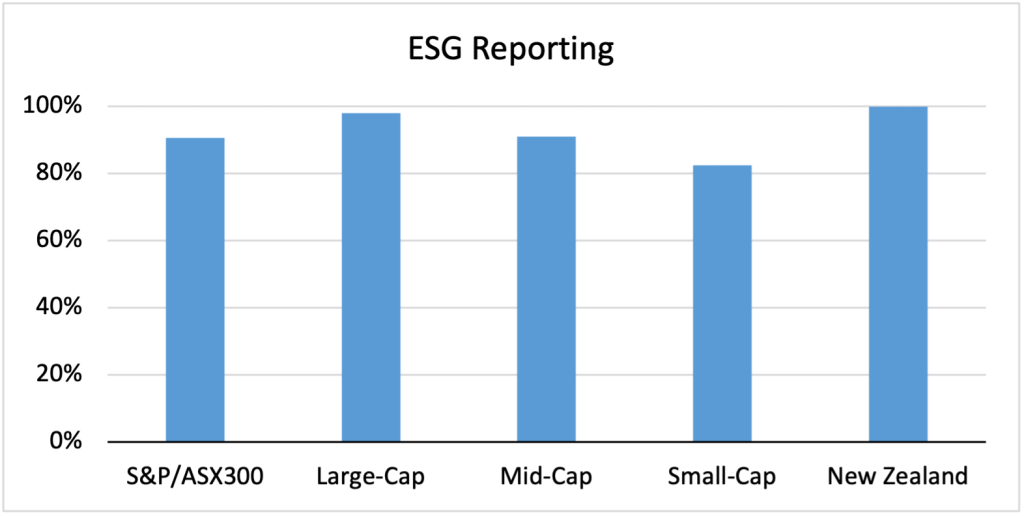

Despite no statutory requirement to report, our analysis shows that the majority of companies in this group have opted-in to an ESG reporting regime. This is most pronounced amongst the Large-Caps (ASX100) where 98% in Australia and 100% in NZ (NZX20) provide this information. However, the majority (82%) of companies at the small end of the ASX300 with market caps of $1-2bn are also very engaged in the process.

Method of disclosure

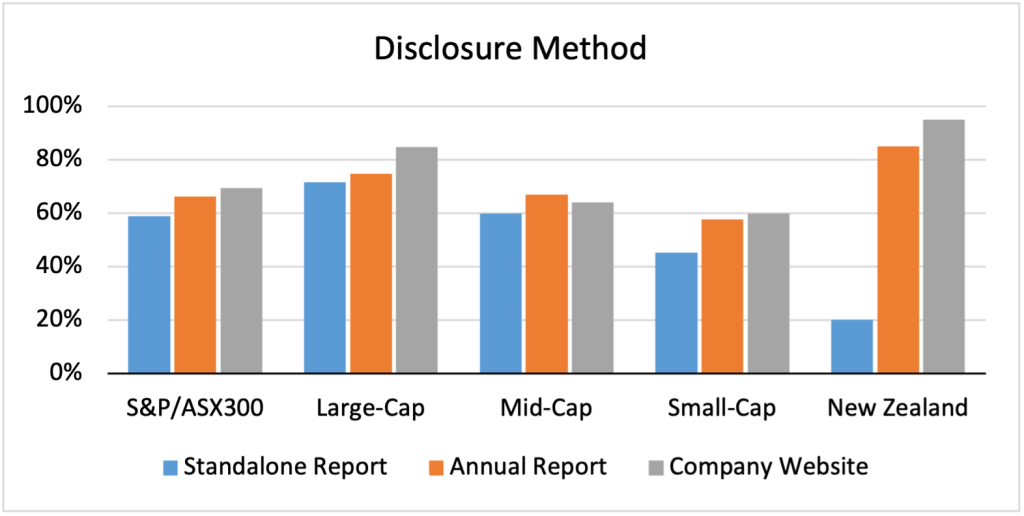

The process of engaging in ESG reporting, regardless of size, is a journey. Most will start off modestly by including a small section in the annual report outlining what is currently being done and the intention for the following year/s. As time goes by, the level of data gathered, and analysis undertaken deepens and standalone reports or a dedicated section of the website might be added. We looked to see if there was any noticeable trend emerging in relation to how companies were choosing to report and concluded that in Australia there is no preferred or dominant approach, as highlighted in the chart below. In NZ however there is a clear bias to using the Annual Report and website with only 20% producing a standalone report. We would note that it was also very common for companies to adopt more than one reporting method. This explains, in part, why 59-69% of companies in the ASX300 are opting for at least one of the three disclosure methods.

In 2019, we noted that 80% of Large-Cap companies were using a standalone report. While this has fallen to 72% in 2021, we have also seen that company websites are the preferred disclosure method for this group of companies, at 85%. A company website targets a broader group of stakeholders compared to a shareholder-orientated annual report. It is also flexible so that the delivery of information can be tailored for stakeholders, which is useful to explain complex ESG-issues.

We see that 60% of Mid-Cap companies (up from 47% in 2019) and 45% of Small-Cap companies (up from 24%) made use of standalone reports in 2021. Companies are tending to choose more dedicated reporting mechanisms for their ESG performance, and while around 60% of Small Caps prefer the Annual Report and Website, the trend towards standalone reports with this group can be clearly seen.

Rapid adoption of TCFD as a reporting framework for Climate Change risk

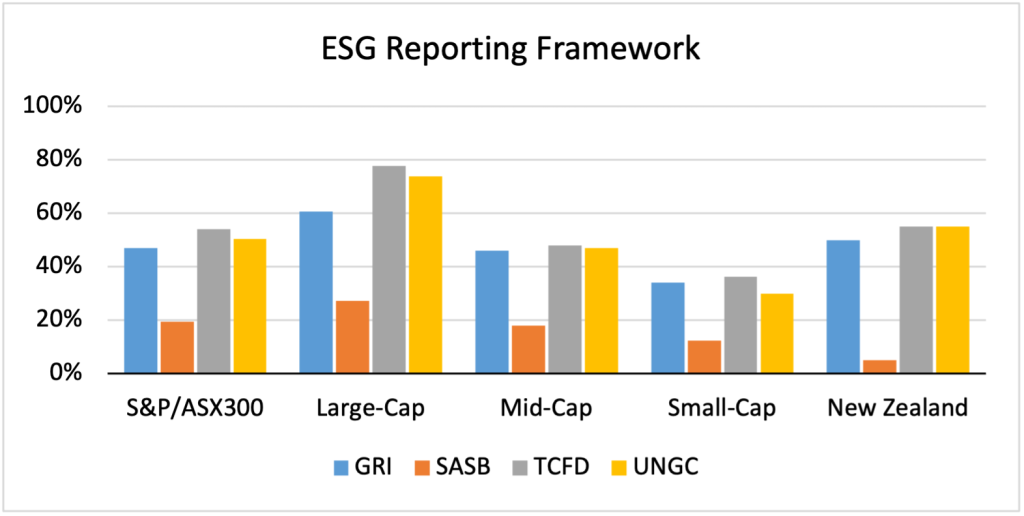

There are four international organisations that are generally acknowledged as setting the standard in ESG: Global Reporting Initiative (GRI), Sustainable Accounting Standards Board (SASB), Taskforce on Climate-related Financial Disclosures (TCFD) and United Nation Global Compact (UNGC), which encompasses the United Nations Sustainable Development Goals (SDGs).

Following on from our study in 2020, we looked at which of these frameworks are being adopted in our sample of Australian and New Zealand companies. In 2019 GRI was leading the way in Australia, but the emphasis has shifted in 2021 as reporting on climate change has taken centre stage. TCFD followed closely by UNGC are now driving ESG reporting in both Australia and New Zealand.

There has been a clear shift in how climate-risk is being assessed in capital markets. This has been, in part, been led by Blackrock Inc. which declared in January 2020 that it was placing environmental sustainability at the centre of its investment approach because climate risk was deemed investment risk. TCFD provides a reporting framework for companies to explain the risks and opportunities presented by climate change and speaks directly to the needs of capital markets for this information.

The industry based SASB reporting standards have been adopted by 19% of Australian companies in our sample, which is consistent with our view in 2020 when SASB was just emerging as a new framework, that this would quickly become a competitive standard. This Standard not only has a particular focus on the information needs of institutional investors but it was also chosen by the International Sustainability Standards Board and the IFRS Foundation in November 2021 as the preferred reporting framework for harmonising sustainability disclosures for the financial markets globally.

Companies are adopting multiple frameworks

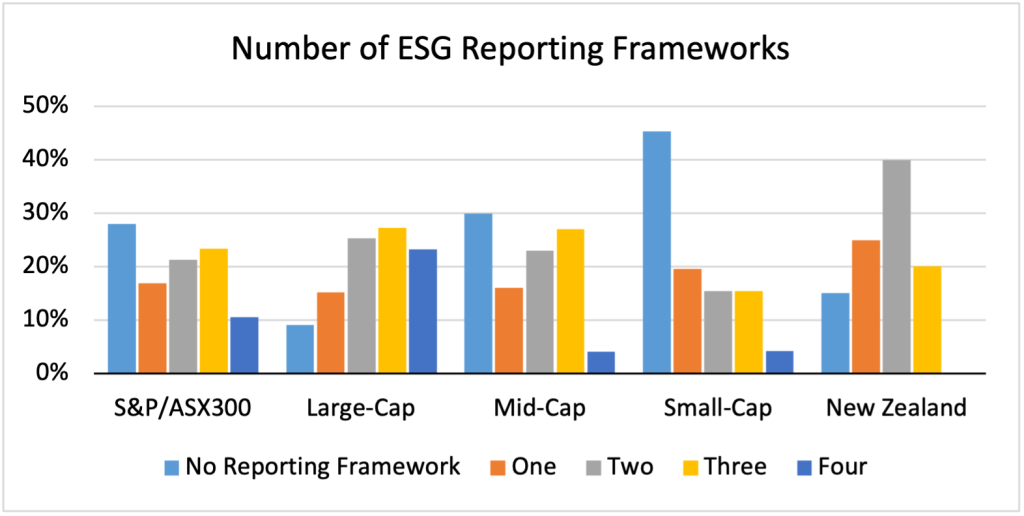

It is not uncommon for companies to adopt multiple reporting frameworks to ensure complete coverage of ESG issues that are relevant to the company and the stakeholder groups they are reporting to. We examine the number of global reporting frameworks used in each company across our sample, below.

We found that 28% of our Australian cohort did not adopt a recognised ESG framework. This was most prevalent with the Small-Caps where just under half chose to take a more narrative-based approach to discussing ESG. By contrast, more than half of our sample of Australian companies (55%) adopted more than one reporting framework. This figure is similar in New Zealand at 60%.

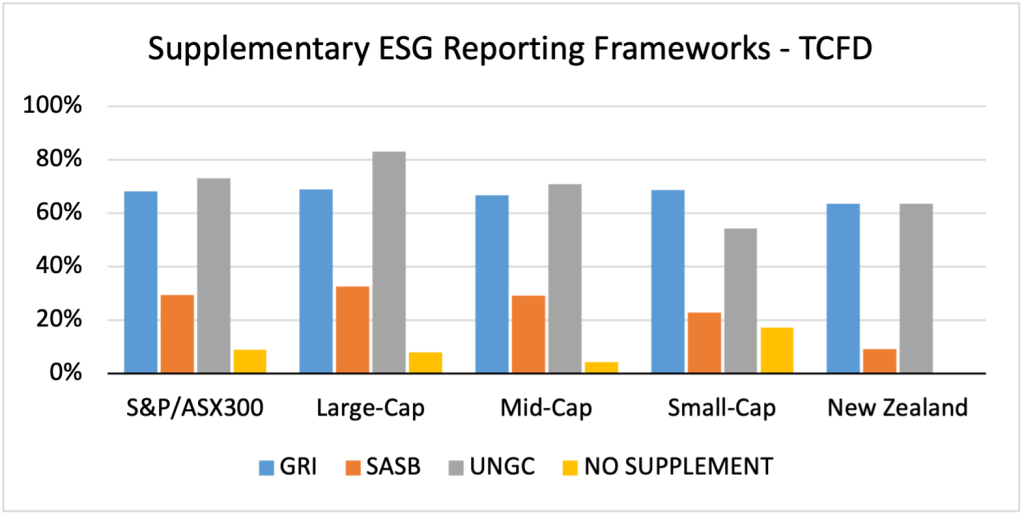

Supplementary reporting with the TCFD reporting framework

Compared to other ESG frameworks, TCFD reporting is focused on the risks to company performance arising from climate change. It would therefore be unusual for this to be the only framework used by companies in addressing the broader subject matter of ESG.

This is confirmed by our analysis that revealed that only 9% of companies that provide climate change disclosure in accordance with TCFD, chose not to use an additional reporting framework. UNGC is the most widely supplemented framework (73%) for those companies that adopt TCFD, followed by GRI (68%).

In our last review, we observed that the preferred GRI reporting framework was only supplemented 58% of the time. It was paired most with UNCG (25%) and TCFD (22%). The trend to supplement reporting frameworks in 2021 highlights that climate change is increasingly been seen by companies as a risk to their corporate performance, and one that is distinct from other ESG issues.

What do we conclude from these findings?

It is immediately apparent that reporting on ESG has become mainstream in Australia and New Zealand for those companies that are institutionally owned with market caps above $1bn. Secondly, we observe that relevant issues for stakeholders are changing quickly, and this requires companies to be agile so they can adapt what and how they report.

In October 2021, New Zealand passed a law requiring insurers, banks and investment managers to report on the impacts of climate change on their businesses from FY2023, becoming the first country in the world to have a climate-related disclosure law in place. The UK will follow this year highlighting the regulatory push towards mandatory reporting.

When it comes to ESG, it is apparent that companies are still left to shop around for the approach that suits them best. This is likely to change within the next few years as the standard setters take control of the agenda to drive adoption of a unified framework. At FIRST Advisers, our strong advice is for companies to get ahead of the curve and look to those frameworks that have received strongest support from the regulatory bodies and global fund managers as they will influence the final decision.