Ben Rebbeck, Executive Director

Environmental, Social and Governance (ESG) factors were once the poor cousins of institutional investors’ metrics – nice to have, but not a primary driver of valuation or investment.

This is no longer the case.

Times have changed, investors are more sophisticated, information is more prevalent and reliable – ESG is now ‘mainstream on Main Street’.

In this article I look at some of the drivers of this change, the attitudes and practices of a selection of influential global investment managers, and what it means for listed companies.

What’s changed?

According to research presented at the 2018 National Investor Relations Institute (NIRI) Annual Conference in June, 47% of global institutional investors place material weight on ESG factors when making investment decisions, and 75% believe ESG is becoming more important. This is in stark contrast to, say, 20 years ago when ESG was almost irrelevant to investment decision making for all but a handful of small specialist funds.

ESG factors have always existed, so it is reasonable to ask, ‘What has changed that makes ESG increasingly important to institutional investors, more so than solely short term profitability?’ And the answer comes in two parts: market composition and decision making.

In 1975, 83% of the S&P 500’s market valuation was comprised of tangible assets. In 2015, 87% came from intangible assets. Coupled with this, in recent years there has been a dramatic rise in Passive institutional investors, who now own an estimated 40% of US listed equities, and have much longer investment time horizons than Active investors.

Secondly, the past 20 years has seen an explosion of available data and therefore the ability of fund managers to analyse and link this data to corporate performance. Also, through organisations such as Market Forces (www.marketforces.org.au), citizens now have the ability to see and consider how the investment choices made by their fund managers influence their lives.

Together, this is neatly summarised by the responses global institutional investors recently gave when asked why they now consider ESG in investment decision making:

-

- 66% used ESG to evaluate risk;

- 60% noted it reflected a change in client preferences; and

- 38% used it to identify investment performance.

How are institutional investors using ESG?

An analysis by global fund manager Putnam Investments of investment managers’ due diligence practices, showed that in 2015, 5% of questions to companies related in some way to ESG matters. By 2017, this rose to a staggering 55%.

This is in stark contrast to the number one question of CEOs and CFOs to Putnam’s fund managers: “Are you sure you care about this [ESG] information?”

Across the investment market more broadly, a recent trend amongst both active and passive institutional investors has been building the ESG proficiency of their portfolio managers. Practically, this means that when a portfolio manager is discussing with a company ‘what your business does’, and ‘how you run your business’ their attention is as much focussed on ESG matters as it is financial.

In a recent presentation to NIRI, Jonathan Bailey, Head of ESG at Neuberger Berman (who manages $110 Billion in equities, and $300 Billion in assets), said that he uses ESG primarily to avoid bad investments and assess investment risks specific to a company or sector. That is, if a company or sector fails on Neuberger Berman’s ESG screening, it won’t be considered as a potential investment.

By comparison, Daniel Nielsen, Head of ESG and Responsible Investing at Chicago based Great Lakes Advisors, revealed that they are moving to make ESG part of every investment decision across the $9 billion in funds they manage. However, their ESG assessment seeks to identify what risks a company is exposed to, how a company deals with risk, and how quickly will they recover from a risk event.

For Great Lakes, they believe this investment approach will deliver better returns and lower risk, while assisting their portfolio managers to make well informed decisions.

In addition to internal assessments, institutions are also increasingly utilising third party assessments and scorecards. The most common coming from:

- MSCI ESG Index – compiled from public data

- Sustain Analytics – a global leader in ESG and Corporate Governance research and ratings

- Oekom – an early developer of ESG assessments and member of global research firm ISS

These examples demonstrate that for listed companies it is important to understand how different institutional investors assess companies – to better understand what types of ESG information and disclosures are required to attract and maintain these investors.

Disclosure implication for companies

The emphasis on ESG investing has increasingly gained momentum as a “preference” screen. Inflows into narrowly focused SRI funds focused on “sin” stocks are dwindling while investing in funds that have an ESG scorecard are growing and requests for additional disclosures to companies are skyrocketing.

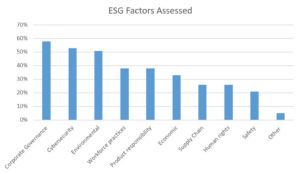

Further, emphasis on different metrics shifts dramatically over time. 5 years ago, carbon footprint was a key area of ESG assessment. This factor is now mostly well understood and appropriately priced into share prices. However, Cybersecurity has emerged as a major ESG area of focus as corporate understanding and disclosure is generally poor but its associated financial and operating risk is enormous. FIRST Advisers identified this as an issue within the Australian context last year, conducting a survey of Corporates to gauge their level of preparedness for the introduction of Mandatory Data Breach Reporting in February this year. While preparedness varied across sectors and size of company, it was very clear that this was an issue that was not even remotely on the radar of most institutional investors.

Source: NIRI 2018 – Survey of global institutional investment managers

Without structure, this increased disclosure can become burdensome – chasing the latest request for information, filling out a 100-page survey, interrogating internal information systems, etc. Fortunately, institutional investors are starting to recognise that this type of ESG interrogation is unhelpful for both their investee companies and themselves.

The broad methodology most commonly supported emphasises:

- Identifying ESG factors relevant to the company’s operations and industry;

- Reporting ESG data that is measurable and clearly linked to performance;

- Utilising an industry standard Reporting Framework; and

- Reporting in a consistent manner over time.

Standard ESG Frameworks

The accepted methodology is no different to how companies measure and report their financial affairs. And like accounting standards, dominant reporting frameworks have emerged, being:

Each of these frameworks adopt a different definition of materiality, or the principle determining which issues are considered relevant in influencing decision-makers. The GRI indicates that a company’s ESG reporting should cover aspects that reflects the organisation’s significant economic, environmental, and social impacts; or substantively influence the assessments and decisions of stakeholders.

The SASB Implementation Guide does not define materiality, but instead refers to “A substantial likelihood that the disclosure of the omitted fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available.” Further, with SASB, each industry grouping has a different set of reporting metrics (determined by industry participants), being those most important to the industry and measurable by it.

Finally, the IIRC states that “an integrated report should disclose information about matters that substantively affect the organization’s ability to create value over the short, medium and long term.”

Of the above, SASB appears to be gaining the most traction, given its clear industry specific reporting frameworks and its focus on investor-centric material ESG information.

Tips for Listed Companies

There is an old maxim that says, “If you’re not telling your story, someone else is.”

When it comes to ESG, this maxim holds true. Given ESG matters are increasingly critical to accessing institutional investment, it is vital that listed companies know what ESG measures are important to their business and then appropriately disclose them, by:

- Reporting to a standard rather than every request for information – we suggest SASB as a first step

- Building a website that is ‘scrapeable’ – the easier investors and agencies can find the information the lower the burden on company resources

- Linking why each ESG factor leads to performance – with data!

- Focussing on key issues – it is rare that more than 5 measures are important to a company’s business.