GILES RAFFERTY Media and Corporate Communications

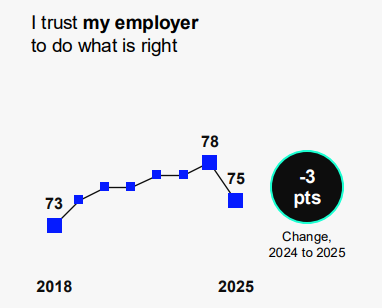

An unprecedented decline in the number of employees who trust their employer to do the right thing – dropping three points globally – as revealed by the 2025 Edelman Trust Barometer is mirrored in Australia where employee trust in their employer dropped 2 points.

The Edelman Trust Barometer is celebrating its 25th year in 2025 and surveyed more than 33,000 respondents across 28 countries, with an average of 1,150 respondents in each country.

The Edelman Trust Barometer is celebrating its 25th year in 2025 and surveyed more than 33,000 respondents across 28 countries, with an average of 1,150 respondents in each country.

On overall trust of business, Government, media, and NGOs, Australia recorded a trust index score of 49, down from 51 in 2024, which translates to an overall level of distrust. Australia’s lowest Edelman trust score of 40 was recorded in 2018, while the highest was 63 recorded in 2016.

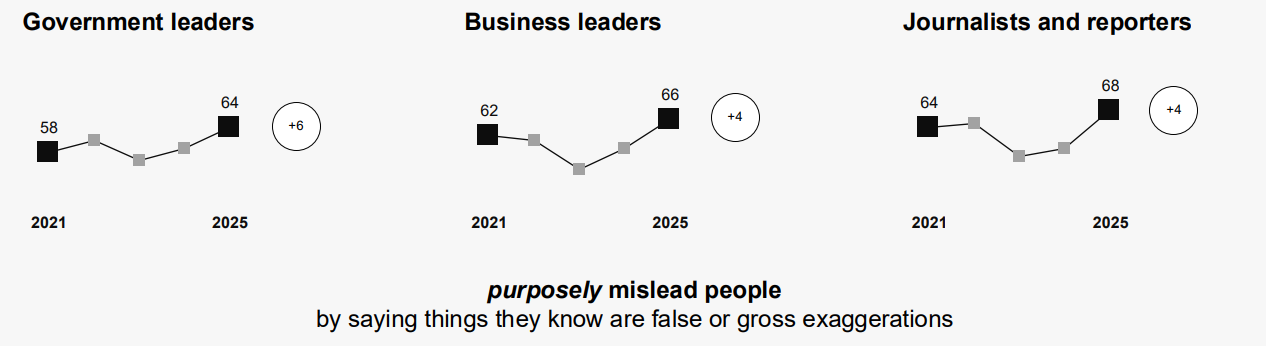

In addition, Australian fears that leaders across Government, Business and the Media are lying are at all time highs of 64, 66 and 68% respectively, as respondents admit they are worried leaders are purposely misleading people by saying things they know are false or gross exaggerations.

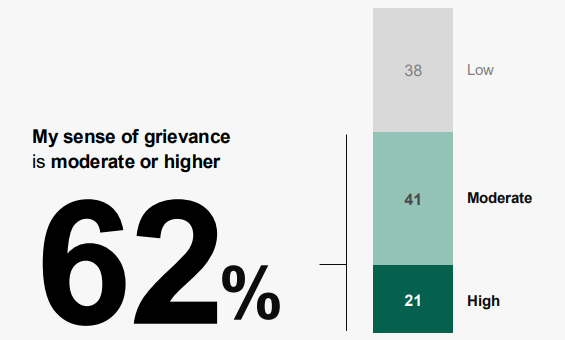

This decline in trust and the view that leaders are lying is translating into a sense of grievance towards Business, the Government and the Rich, with 62% of Australian respondents, or 6 out of 10, saying their sense of grievance is moderate or higher. This sense of grievance is derived from the view that Business and Government serve a select few and that their actions hurt regular people; that the system favours the rich and the rich are getting richer; and that the media is complicit in supporting this system.

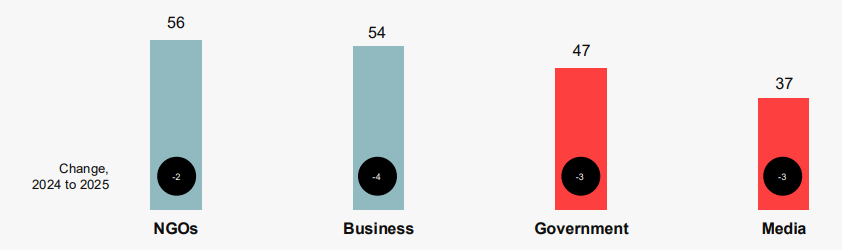

It is not all doom and gloom. If we compare Australian business, government, media, and NGOs individually the survey reveals that Australian businesses are still trusted with a score of 54%, down 1% on 2024, and NGOs are at 56% despite a 2% decline compared to 2024. The government and media, however, have a trust deficit with both slipping 3% to 47% and 37% respectively.

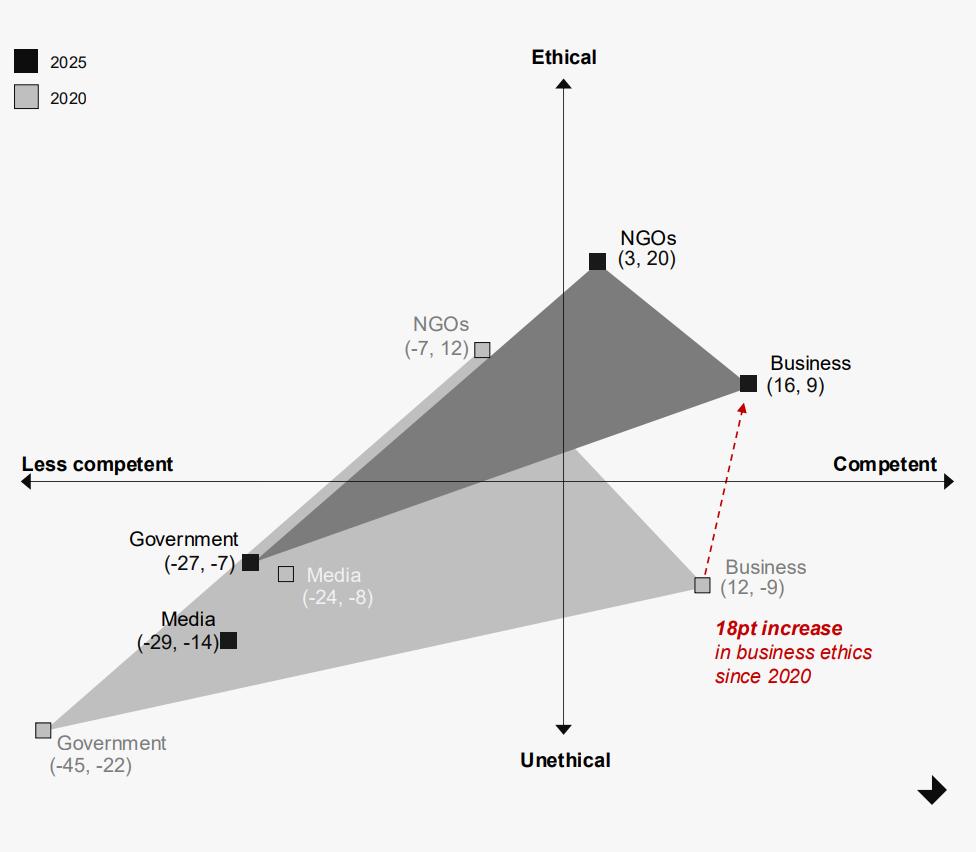

The Edelman Trust Barometer defines trust as the combination of competence and ethics. Overall business is seen as the most competent and also an ethical institution, while NGOs are seen as the most ethical but not as competent as business. The Australian Government and Media are revealed in the survey as being neither ethical nor competent.

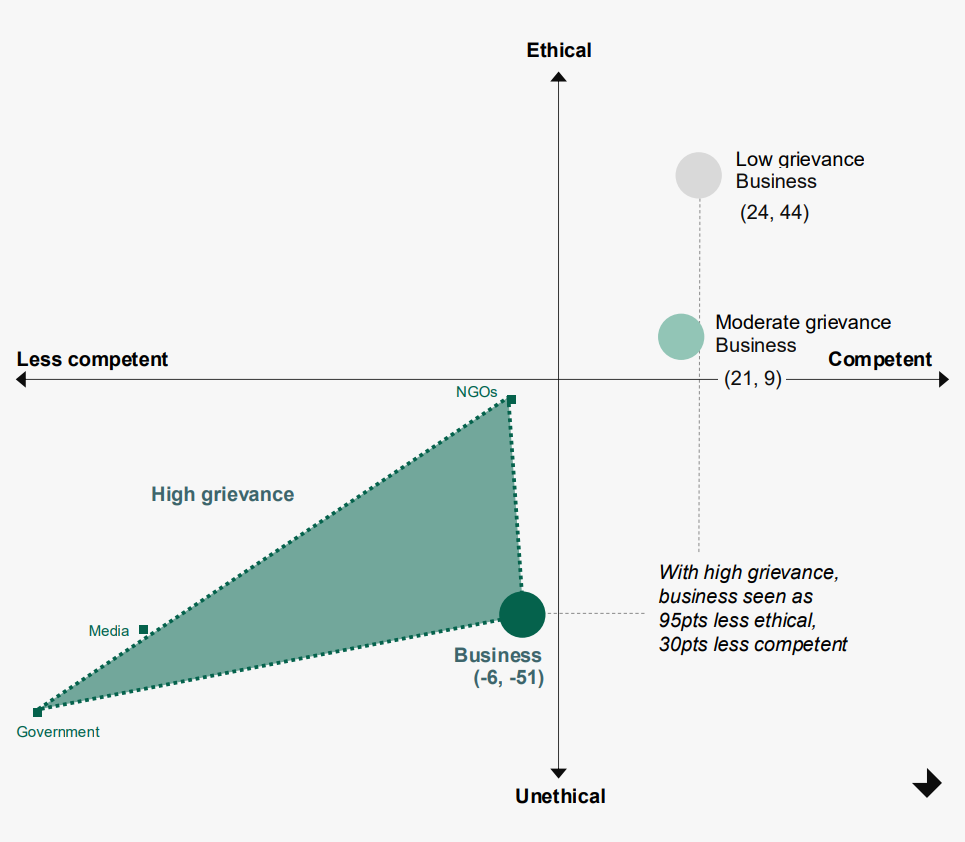

When we factor in the sense of grievance, that has also been revealed by the survey, we find the 21% of Australian respondents that reported a high sense of grievance see business as neither ethical nor competent.

Interestingly, the survey shows that respondents with a high sense of grievance are actually demanding more action from businesses on the key issues that could help restore trust. 76% of the most aggrieved say business is not going far enough to address affordability, 62% want business to do more on climate change and 61% want more action by business to tackle misinformation.

There is also a broad sense that CEOs should act on societal issues where they can make a major impact on the challenge (80% across low, moderate and high grievance cohorts) and doing so would improve business performance (72%). There is also a view that CEOs are justified in addressing a societal issue if their business contributed to the problem (75%) or the issue harms their customers, employees or communities (74%).

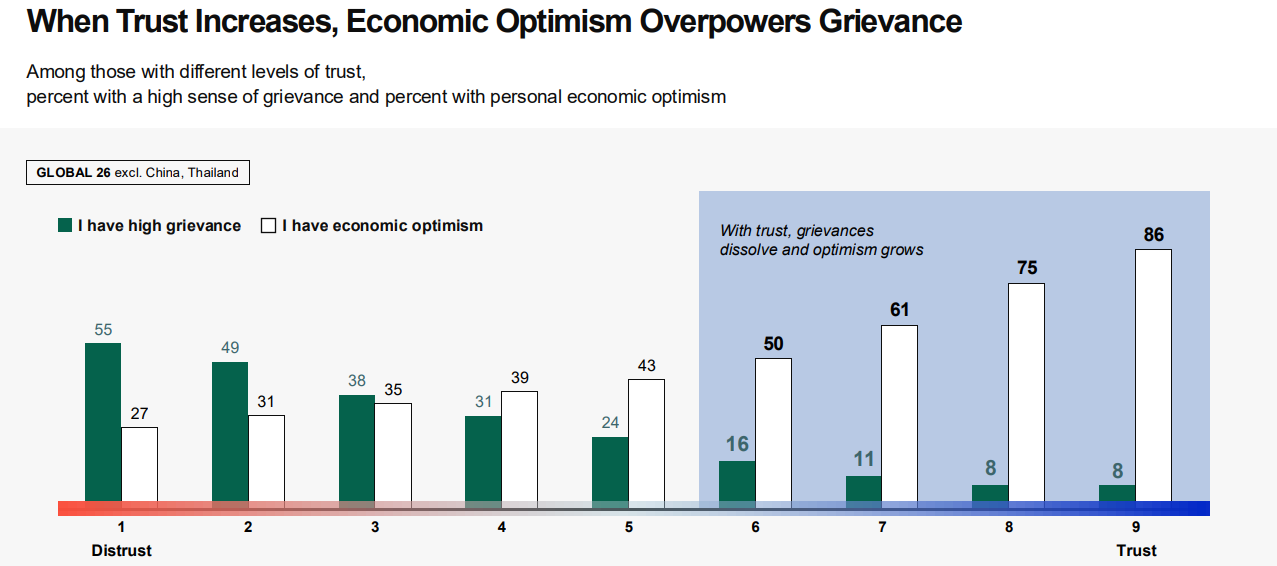

A positive finding within the survey is that as trust increases the sense of grievance diminishes and gives way to a sense of economic optimism.

As one of the institutions that is shown by the survey to have hung on to trusted status, business is well placed to play a significant part in helping to foster an increase in trust and economic optimism. But business cannot do this in isolation. NGOs also remain trusted institutions according to the Trust report and are called out as having a role to play in fighting divisiveness and repairing the fabric of society by bringing people together.

While the Government and Media are the two institutions in the report revealed as not trusted they too have roles to play in creating economic optimism. The challenge to Governments is to earn legitimate authority by delivering results that positively impact on regular people’s lives and demonstrate understanding of what regular people need. For the media it is even simpler, put the facts first. Something for both parties to bear in mind as Australia heads into an election.

FIRST Advisers is well placed to help Businesses demonstrate how they are working to restore trust and build economic optimism. As an integrated IR agency, we have investor relations, corporate communications and financial PR all under one roof to ensure companies can effectively and consistently communicate with all stakeholders.