DAN JONES, MANAGER SHAREHOLDER ANALYTICS

In April 2020, we wrote that more than 80% of companies withdrew their FY20 guidance amid uncertainty surrounding COVID-19. During the February 2021 earnings season, we recommenced monitoring the results of S&P/ASX300 companies to establish to what extent the provision of guidance has been re-adopted and how companies are viewing (the remainder of) FY21.

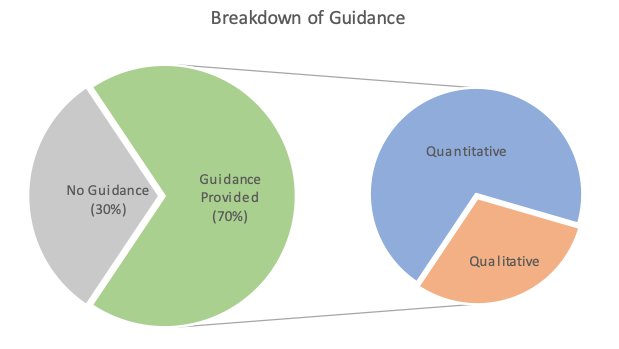

In analysing the nature of guidance, we looked at whether it had some quantitative elements to help define outlook, or if it was purely qualitative. If there was a mixture, for the purposes of this report it was considered as quantitative.

Qualitative Guidance has become more popular since COVID-19

Despite a similar percentage of reporting companies giving guidance (70%) in February 2021 to February 2019 (71%), we identified a change in the way it is delivered with 30% of companies choosing to provide it in a qualitative manner.

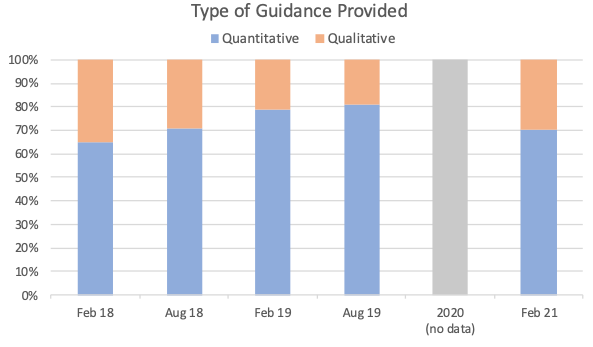

This reverses the pre-COVID 19 trend of quantitative guidance becoming more widely adopted. The share of companies providing quantitative guidance had steadily grown from 65% in February 2018 to 81% by August 2019 (the last time we conducted an investigation).

The majority of sectors increased the proportion of qualitative guidance they provide

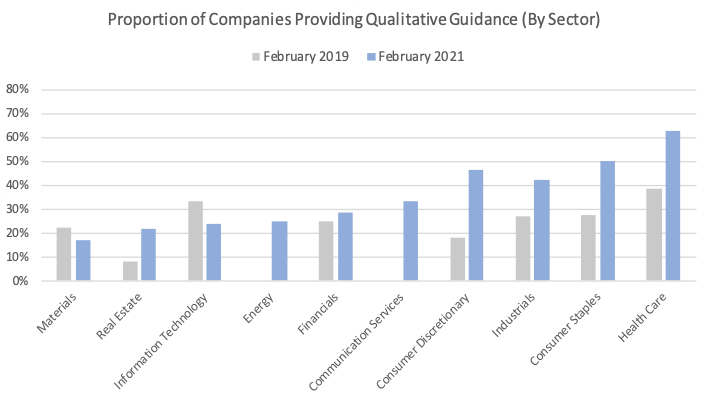

The proportion of companies giving guidance qualitatively increased in all but three sectors (Utilities, Materials and Information Technology).

Healthcare, which gave the highest proportion of qualitative guidance in both 2019 and 2021, was the only sector with more than half of constituents providing guidance in a qualitative manner (63% up from 38%). Other sectors experiencing notable changes were Consumer Staples (45% up from 27%), Industrials (42% up from 27%), Consumer Discretionary (42% up from 18%), Consumer Staples (50% up from 27%) and Communication Services (33% up from 0%).

Other than Utilities, where all companies that provided guidance did so quantitatively, the sectors with the greatest provision of quantitative guidance were Materials (83%) and Real Estate (79%).

Notably, 64% of companies in the Materials sector provided non-financial guidance – most commonly giving their outlook on Production volumes – which was the highest of any sector.

Smaller companies give more qualitative guidance

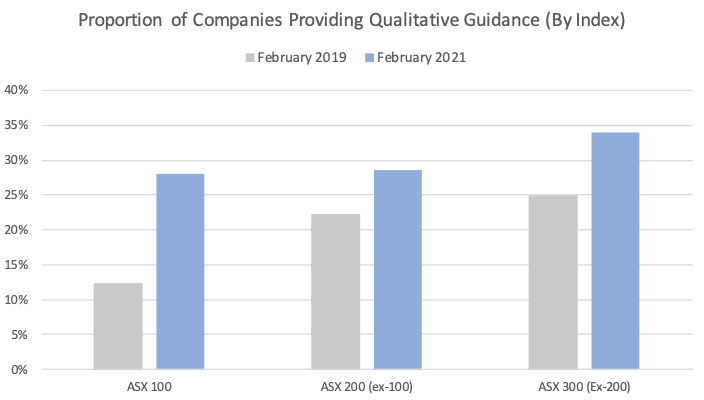

The findings showed that companies of all sizes within the ASX300 provide more qualitative guidance this time compared with February 2019.

Small cap companies – defined as ASX300 (Ex-200) – gave qualitative guidance 34% of the time, which was up from 25% in February 2019. Large Companies (ASX100) and Mid-Cap companies (ASX200 Ex 100) each gave qualitative guidance 28% of the time, compared to 12% and 22%, respectively, in 2019.

Notwithstanding this, we found that ASX20 members continue to provide qualitative guidance at an above average rate – 38% of their guidance was qualitative, compared to the ASX300 average of 30% – and often provided information on key segments, rather than giving a group-wide outlook. This is consistent with previous investigations.

The rate of companies providing guidance is around Pre-COVID levels

We found 70% of reporting companies provided guidance in their results announcement, which was broadly in line with our findings in the February 2019 reporting season (71%) and marginally below February 2018 (73%).

The rapid re-emergence of guidance may in part reflect the recent changes to Guidance Note 8, which we wrote about last month. Entities are now required to “consider notifying the market of a potential earnings surprise if any when it expects there to be a 15% or greater difference between its actual or projected earnings for the period and its best estimate of the market’s expectations for its earnings…”.

Guidance is mostly positive

Our analysis suggests 68% of companies provided guidance that was positive or optimistic about FY21. This observation is consistent with recent findings of Morgan Stanley that, in the lead up to February, there were two profit updates for every downgrade (www.afr.com).

Healthcare, which provided the lowest concentration of total guidance and the highest proportion of qualitative guidance, was the most optimistic about the future with 88% of companies expecting an improved FY21 result. This may in part reflect the fact that companies who are proportionally more affected by the health crisis, and therefore less optimistic, were unable (or unwilling) to restate guidance after withdrawing it.

The next most optimistic sectors were Financials (86% had a positive outlook), Communication Services (82%) and Materials and Real Estate (71% each). Utilities and Industrials were the most cautious about the future.

There was no discernable difference when breaking down the optimism of outlook by Index.