VICTORIA GEDDES, Investor Relations

For the past 3 years FIRST Advisers has been tracking Australian companies preparedness for the task of reporting on their Environmental, Social and Governance (ESG). This was in response to the obvious momentum that was building globally around the impact of climate change as well as growing evidence attributing superior performance to those companies that integrated ESG into their strategic framework. It also reflected the reality that at some point ESG reporting would become mandatory. Our first review of ESG disclosure practices began with data collected in 2020 and 2021. This review of 2023 will highlight what has changed since then and assess how well-placed Australian, and NZ’s top 20, companies are to reporting in line with the new global reporting standards.

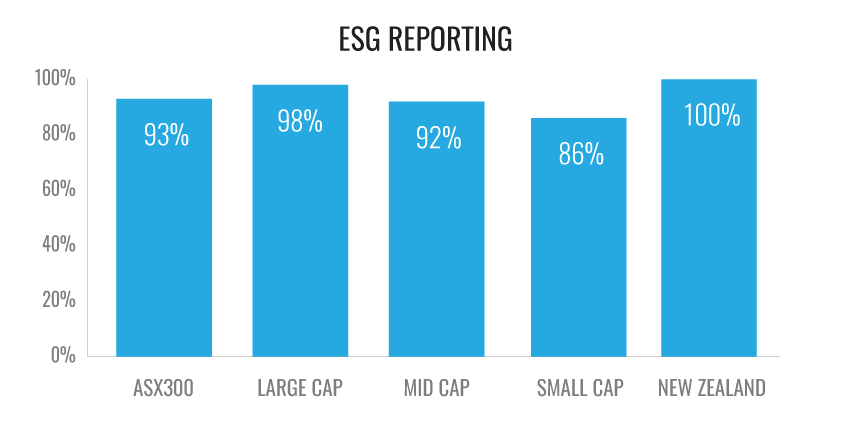

High Level of Adoption of ESG Reporting

Our review is focused on companies in the S&P/ASX300, segmented by market cap into Large-Cap (the S&P/ASX100), Mid-Cap (the S&P/ASX100-200), and Small-Cap companies (the S&P/ASX200-300). We also provide an update on ESG Reporting in New Zealand where climate change reporting became mandatory this year for 200 entities, including all listed companies with a market capitalisation over NZ$60m. Our survey includes the top 20 New Zealand companies by market capitalisation. By definition, the companies included in each segment will be slightly different each year.

While the reporting of ESG performance is not mandatory in Australia the majority of the top 300 (93%) have embraced the practice. This is most pronounced amongst the Large-Caps (ASX100) where 98% in Australia and 100% in NZ (Top 20) provide this information. Importantly, the majority (86%) of companies at the small end of the ASX300 with market caps of $0.5 – 1.5bn have also been very engaged continuing to improve their participation over the past two years (82% in 2021).

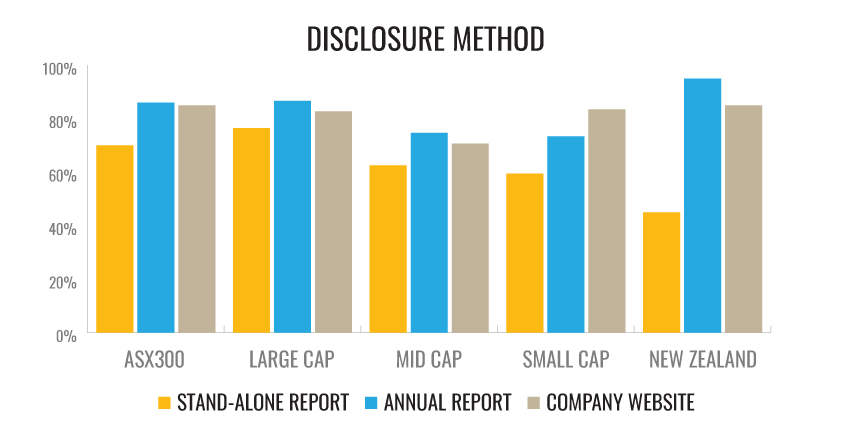

Companies can choose how they wish to provide this information and will typically adopt one or more of three approaches – a standalone ESG report, ESG disclosure within the annual report, and/or provide a section dedicated to ESG or Sustainability on the company’s website.

In terms of what is reported, companies have also been free to choose from a number of frameworks that set out a range of qualitative guidelines and/or quantitative metrics. Apart from Climate Change reporting, the result has been a melange of data points and subject matter disclosure. This is expected to change in 2024 following the release this year of the International Sustainability Standards Boards (ISSB) first two Sustainability Disclosure Standards: IFRS S1 and IFRS S2. On 23 October the AASB also released its Exposure Draft (ED SR1) Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information to propose climate-related financial disclosure requirements for Australian companies. This directly references IFRS S1 and IFRS S2 as the baseline standards and is open for comment until Friday, 1 March 2024.

Preferred Methods of Disclosure

The aim of this analysis was to see if there was any noticeable trend emerging in relation to how companies were choosing to report. From 69% of ASX 300 companies including a Sustainability section on their website in 2021, this increased to 86% in 2023, matching the preference to include ESG reporting within the Annual Report. The average number of Australian companies electing to produce a standalone report (70%) has also increased from 59% 2021. In NZ the bias to using the Annual Report (85%) and the Website (95%) remains unchanged while standalone reporting (45%) has risen from 20% in 2021. The increase reflects two factors – a group of companies wanting to produce comprehensive commentary on their sustainability initiatives in a standalone report with a reduced level of disclosure in the annual report together with a smaller number of companies that reproduce the annual report content as a standalone sustainability report.

We would note that it was also very common for companies to adopt more than one reporting method with 46% of large caps in the ASX300 reporting across all three channels and 30-35% of small and mid-cap companies choosing two.

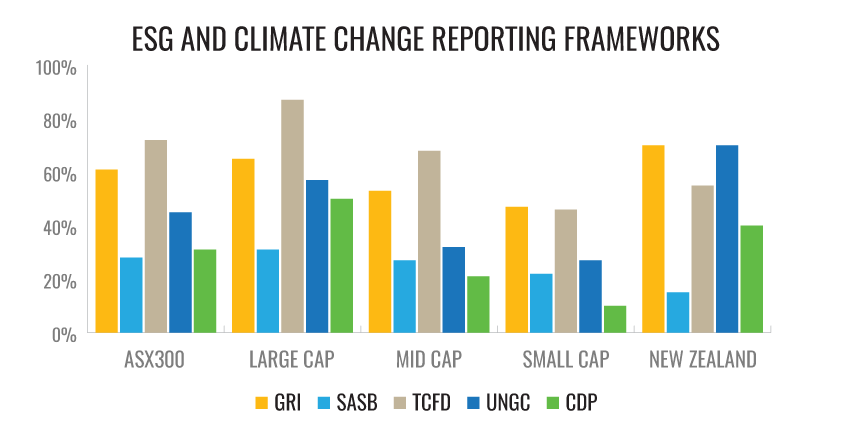

Current choice of Reporting Framework will determine preparedness for IFRS S1 and S2

There are five international organisations that are generally acknowledged as setting the standard in ESG – Global Reporting Initiative (GRI), Sustainable Accounting Standards Board (SASB), Taskforce on Climate-related Financial Disclosures (TCFD), CDP and United Nation Global Compact (UNGC), which encompasses the United Nations Sustainable Development Goals (SDGs).

The recently released global reporting standards were primarily based on SASB (IFRS S1) and TCFD (IFRS 2) with industry-specific disclosures reporting according to the SASB industry standards as a non-negotiable starting point. In relation to metrics, companies must also adopt those recommended by SASB but can also include GRI metrics if it serves the information needs of investors. IFRS S2 sets out specific climate-related disclosures and has fully incorporated the recommendations of the TCFD.

The industry based SASB reporting standards have been adopted by 31% of Australian large cap companies compared with 27% in 2021 (19% 2020). SASB is focused on the information needs of investors and other providers of capital so is heavily focused on data and financials. It is now viewed as a proxy for implementation of IFRS S1 and 2, including the adoption of industry-specific disclosures, for the identification of sustainability-related risks, opportunities and related metrics. This is consistent with our view in 2020, when SASB was just emerging as a new framework, that this would quickly become a foundation standard.

Established in 1997 GRI has led the way in Australia and continues to have a strong presence with 47-53% of small and mid-caps and 65% of large caps using their framework. Just over 70% of NZ’s top 20 used GRI this year, a significant increase from 50% two years ago. Compared to the narrow investor focus of SASB and ISSB, GRI seeks to meet the broader information needs of other stakeholders, so companies will need to put in place the measures being designed by GRI and ISSB to ensure alignment with the new standards.

UNGC has been a popular framework in Australia however its attraction appears to be waning with 57% of Large-cap companies using this as a disclosure mechanism compared to 74% in 2021. Adoption by Mid-caps fell from 47% to 32% while Small-caps stayed around 30%. By contrast the uptake by NZ’s large caps accelerated in that time from 55% to 70%. UNGC is a call to companies to align their strategies and operations with ten universal principles related to human rights, labour, environment and anti-corruption, and take actions that advance societal goals and the implementation of the Sustainability Development Goals (SDGs).

CDP reporting by ASX300 (31%) places it behind GRI and UNGC, a pattern repeated in New Zealand where 40% of the 20 large cap companies used CDP versus 70% using GRI and UNGC. It is an extensive questionnaire primarily focused on environmental issues and assessing the impact on climate, water, and forests.

Compared to the financial reporting guidelines at the core of IFRS S1 and S2, the topics and issues covered by CDP and the UNGC are qualitative in nature and broader in scope. It is likely therefore that companies will continue to use these frameworks where appropriate to support their ESG disclosures.

TCFD has been providing a reporting framework for companies to explain the risks and opportunities presented by climate change since 2015 and speaks directly to the needs of capital markets for this information. It will continue to do so from 2024 following its adoption in full as IFRS S2. Compared with 2021, all Australian companies increased their TCFD reporting from an average 54% to 72% in 2023, led by Large-caps (87%). NZ’s adoption rate remained at 55% however we would expect that to increase to 100% over the next year given that mandatory climate-related disclosures commence for companies with a financial year commencing on or after 1 January 2023 ie calendar 2023 or FY24.

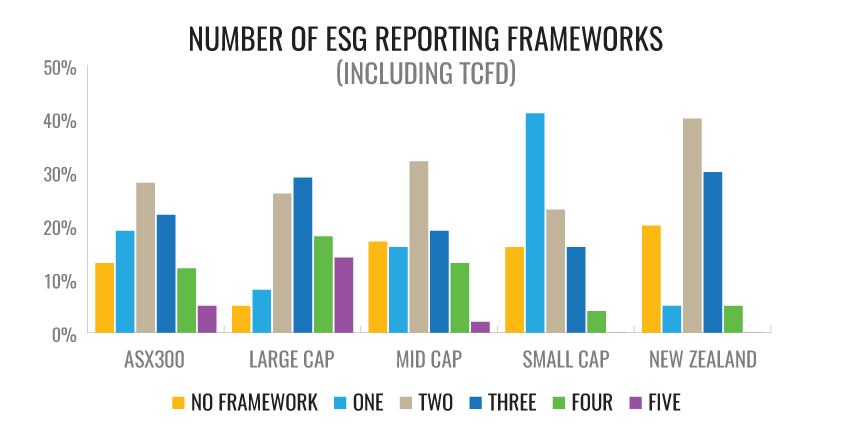

Companies rarely report using only one ESG framework

It is not uncommon for companies to adopt multiple reporting frameworks to ensure complete coverage of ESG issues that are relevant to the company and the stakeholder groups to which they are reporting. We examine the number of reporting frameworks used by each company across our sample, below.

Only 19% of our sample of Australian companies and 5% of NZ Large caps adopted only one reporting framework with Australian Small-caps (41%) dominating this group.

Amongst Australian Large-caps 26-29% used 2-3 frameworks and another 18% used four. A third of Mid-caps used 2 frameworks with 19% and 13% of these companies respectively using 3 and 4 different frameworks.

Only 13% of our Australian cohort either did not report on ESG at all or did not adopt a recognised ESG framework – a significant decline from 28% in 2021. The decline was most prevalent amongst Mid-Caps (17% from 30% in 2021) and Small-Caps (16% from 45%).

The adoption of Scope 1, 2 and 3 metrics

The TCFD requirement for companies to measure their carbon emissions is one that is causing the greatest impost in terms of data gathering, particularly Scope 3.

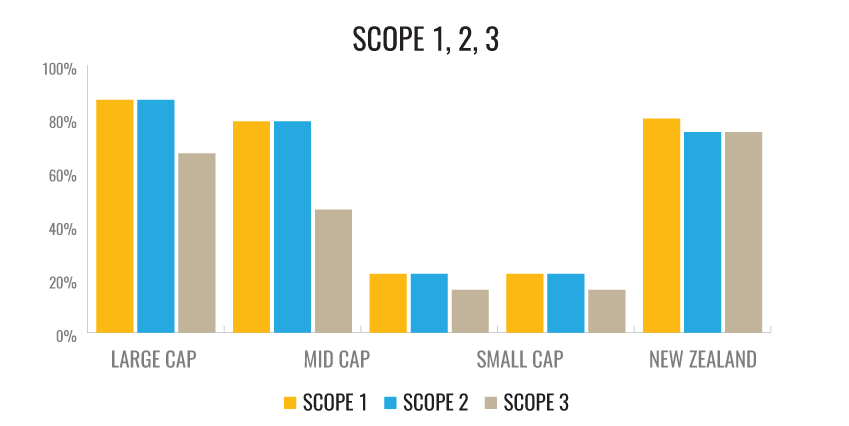

Scope 1 emissions are those generated from sources that the company owns or controls directly while Scope 2 emissions are indirect emissions that are a consequence of a company’s activities but occur from sources not owned or controlled by it, such as electricity usage. 80-85% of Australia’s Large and Mid-Cap companies and 75-80% of NZ’s large caps are comfortably reporting on these. In stark contrast only 22% of Australian Small-caps have started to come to grips with this.

Scope 3 emissions are the most challenging as they include all sources not captured by Scope 1 and 2 that are created in a company’s value chain. At present 67% of Australian Large-cap and 75% of NZ’s top 20 are addressing Scope 3 reporting. ISSB have given companies an extra year (2024/2025) to make the changes but have also acknowledged that they don’t expect the same comprehensiveness from small and midsize enterprises as from large multinational companies.

In Australia the expectation is that Large-caps will be required to adhere to the AASB climate-related financial disclosure framework by 2025-26 and in NZ mandatory climate-related disclosures commence for companies with a financial year commencing on 1 January 2023. While Mid and Small-cap companies have longer to adjust, close to half of Mid-cap companies are already voluntarily reporting Scope 3.

Conclusion

ESG has become mainstream in Australia and New Zealand for those companies that are institutionally owned with market caps above A$650m (ASX300) and NZ$75m. We have however moved into the next phase when alignment of reporting to the global ISSB standards begins in earnest. While mandatory reporting commences in NZ this year and is expected to be phased in from FY25 in Australia, both reference the ISSB standards as the baseline which in turn have been modelled on the SASB and TCFD frameworks.

Companies which have adopted frameworks other than SASB and TCFD will need to recalibrate their reporting to ensure they meet these standards. It does not mean abandoning GRI, UNGC or CDP, each of which have different areas of focus, but it will ensure that there is a core of information presented that is consistent with companies globally.

At FIRST Advisers, we have been providing support to companies on their ESG reporting for the past 3 years. We are expanding this in 2024 to include support on measuring and reducing companies’ carbon emissions. Contact us for further information on admin@firstadvisers.com.au.