VICTORIA GEDDES, Executive Director

There are two big trends emerging in funds management and both have implications for how companies engage with the shareholders on their register, target new investors and determine the optimum composition of their register for funding long term capital growth.

The Rise of Passive Funds…

The rise of passive funds, and in particular ETFs, over the past 20 years has come into sharper focus in recent years. Share registers of the top 200 listed companies have become increasingly populated by index and other passive funds, raising speculation as to whether management teams will have anyone to visit on their twice yearly post results roadshows within the next 10-20 years.

The problem has been compounded over the past couple of years as active managers, including hedge funds, have struggled to deliver performance, highlighting the longstanding issue of ‘management fees’. This can be as much as 2.0% on large cap and 2.5% on small to mid cap managed funds – before performance fees.

…as active managers continue to underperform

In 2018, 86.7% of large cap equity managers underperformed their benchmarks. This might be tolerated as a one-off due to a bad year if not for the fact that S&P Dow Jones’ SPIVA Australia Scorecard, which has been tracking the performance of funds since 2000, reported that when measured over 5 and 10 years, 79.6% and 83.2% of funds respectively, underperformed the S&P/ASX200 on an absolute basis.

The Future Fund, Australia’s $175bn sovereign wealth fund, is increasingly undertaking its own asset management rather than outsourcing, and is about three-quarters of the way through a plan to move its $23 billion equities program to a “more passive or factor- and rules-based approach”. For the last two years, it has been introducing the same approach to its global equities holdings, transitioning away from long-only, active-equity managers. This move has in large part been driven by their view of the disruption that is coming to the investment management industry in the next few years as a result of the billions of dollars being poured into the development of investment technology.

A study released by VanEck, a global ETF provider, last month estimated that “65% of active managers will likely be disrupted by smart beta” because investors are able to achieve the same outcome at a lower cost using this strategy and that “Australian equity managers that continue to charge high fees while only delivering performance that can be matched or bettered by smart beta, face extinction”.

The Rising Influence of Asset Owners…

The other big trend driving the shape of Australian share registers is the move by asset owners, particularly the big industry superfunds, to insource investment management as their funds under management grow. In addition to the Future Fund, these include AustralianSuper, First State, Sunsuper, QSuper, REST, Cbus, Vision Super, HESTA and Telstra Super. These funds have also benefited over the past year from significant fund inflows in the wake of revelations about poor practices within the wealth management operations of the four major banks and AMP during the Royal Commission into Banking. AustralianSuper recently noted that its 90% increase in fund inflows in FY19, was largely new money coming in at the expense of for-profit funds.

So what are the practical implications of this for companies and how they manage their interactions with shareholders? The large industry funds have a strong focus on governance which is particularly evident around AGM time. They take their responsibility of stewardship seriously, not just from the perspective of delivering investment returns to their members but also the importance of integrating ESG considerations into the investment decision making process.

…is bringing ESG increasingly to centre stage

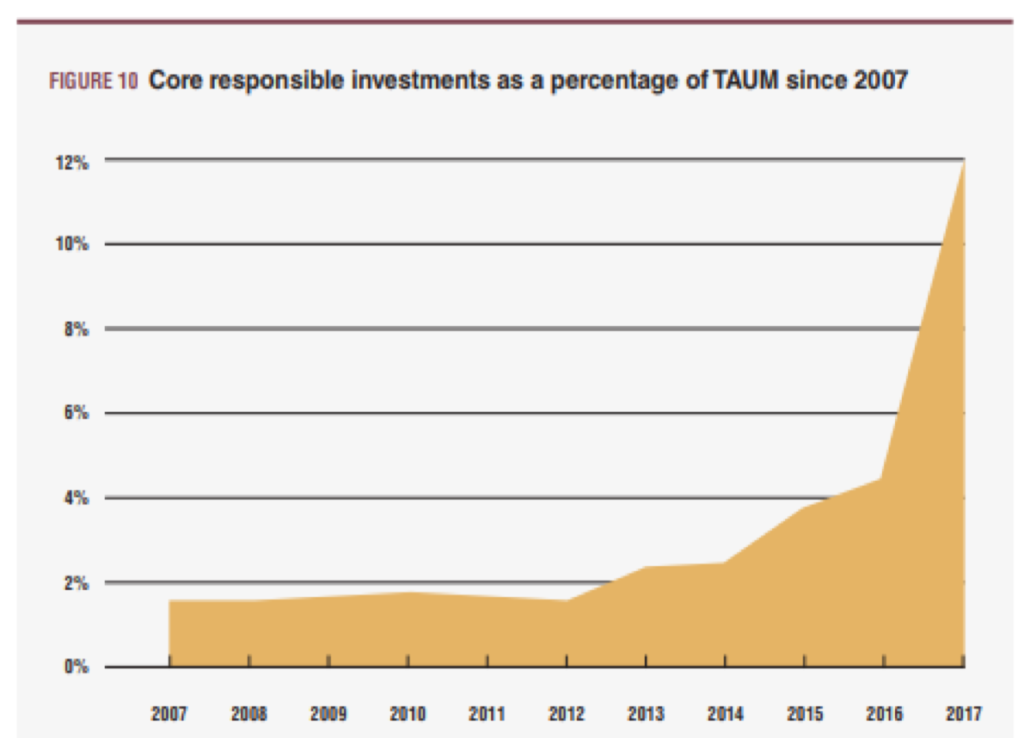

This trend towards a heightened focus on ESG has been in place for at least the last 5 years in Europe and the US and has now begun to move to centre stage in Australia. Anecdotal evidence suggests it is now not uncommon for investor presentations to European investors to focus solely on ESG with a review of the financials either completely absent or confined to the appendices.

The dominant global index funds – Blackrock, State Street and Vanguard – together with the powerful industry funds in Australia are already shifting the conversations with boards and management teams towards sustainability issues. Last year a report published by the Global Reporting Initiative[1] highlighted that investors are increasingly expecting companies to report on the Sustainable Development Goals (SDGs) relevant to their operations and their impact on company strategy and financial performance.

The three most popular areas of focus[2] are currently climate risk and the transition to a low carbon economy; corporate culture, purpose and reputational risk; and human capital management. These big index and industry funds, and the proxy advisers that represent them, have the ability to sway votes at proxy time because they take the process seriously and have frameworks in place to assist in evaluating how companies are addressing these areas. Companies might not agree with their judgement, which at times can be flawed and overly prescriptive, but their scrutiny is here to stay as institutional investors escalate their stewardship obligations as part of their push to impact capital allocation investment decisions.

[1] July 2018 joint report by the Global Reporting Initiative, the Principles for Responsible Investment and the UN Global Compact

[2] Morrow Sodali Institutional Investor Survey 2019