VICTORIA GEDDES, ECECUTIVE DIRECTOR

In the past 5 years, post-GFC in particular, the activist investor has become firmly established as a recognised investor category within the funds management universe. Companies are starting to build into their investor relations strategy protocols that quickly elevate early signs of shareholder discontent up to the board. Politely acknowledging, but effectively ignoring, repeated grumbles from particular shareholders about capital management, board composition, strategy or the company’s profitability, in the expectation that they will eventually go away is no longer an acceptable default position (if it ever was).

Activism is not what it was in the 1980s when boards lived in fear of corporate raiders like Ron Brierley, John Spalvins and Robert Holmes á Court appearing on their register.

Private equity has taken over this disruptor function within the capital markets. While their approach is different, their end game is often the same – take public companies private to effect changes to the business and strategy.

Activist behaviour is less about taking a company private to effect change, as it is about shaking things up, putting the board on notice that shareholders are not satisfied and demanding change. Compared to private equity investors’ 3 to 5 year investment horizon, the activist investors’ timeframe for action is immediate.

Activism on the rise

| Number of companies subject to activist demands in 2015 | 551 |

| Increase in global activism over past 5 years | 288% |

| Increase in activism in Australia in 2015 | 27% (to 57 events) |

| Markets with the strongest growth in activism in 2015 | USA, Asia and Australia |

| Success rate of activism in Asia (including Australia) in 2015 | 46% (vs 30% in 2014) |

Source: The Activist Investing Annual Review 2016

Emergence of Activist Hedge Funds

High profile activist hedge funds come to mind when many investors think of activism. Like private equity, their strategy is often to engage with the company to drive an agenda.

In the US they will wage proxy battles, roll boards, demand the sale of assets and even launch takeovers. According to JP Morgan, activist hedge funds have grown tenfold since 2003 to manage $US123bn in assets. Research by Houlihan Lokey[1], identified that since 2005, while only 9.5% of unsolicited bids from hedge funds have been successful, 42% of US companies targeted by a hedge fund eventually ended up being acquired by a third party.

Working Behind the Scenes

In Australia, we have tended not to see this type of openly aggressive approach. Activists have instead preferred to engage management behind the scenes.

LIM Advisors, a Hong Kong based hedge fund with a long standing investment in the ASX listed AMP Capital China Growth Fund (AGF), is one such example. For a number of years LIM favoured working behind the scenes and only resorted to open activism after perceiving that AGF was failing to respond to their repeated suggestions of ways in which it might improve its performance. They requisitioned a meeting, raised the issue through the media, analysed the Fund’s unitholder register, engaged directly with unitholders and ran a proxy campaign. The groundswell of support they received made it difficult for AMP to ignore, resulting in a number of initiatives to address unitholders’ concerns.

Institutional investors with an “activist style” are also becoming more prevalent in Australia. Sandon Capital, Wilson Asset Management, Allan Gray and Thorney Group, to name a few, have been operating in this space for many years. They too leverage holdings, sometimes less than 5%, to start the conversation and gather support from other shareholders to indicate the extent of concern held about a particular issue.

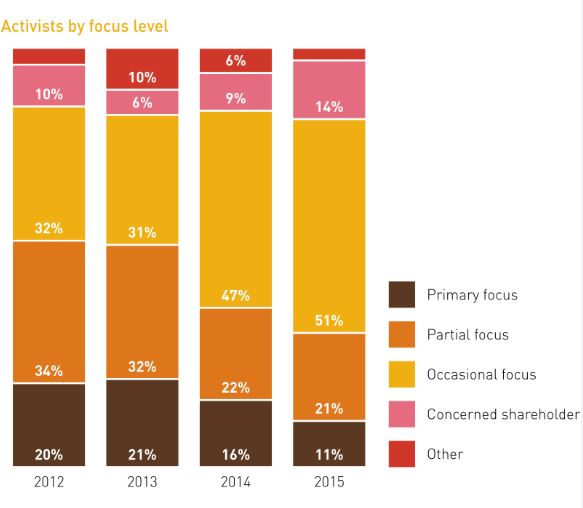

Research by Activist Insight[2] contained in their Annual Review 2016 highlighted a trend for companies to be targeted by the ‘occasional’ activist ie one who engages management every so often. The number of activists that fall into this camp leapt from 32% in 2012 to 51% in 2015 (see chart). If you add to that the 14% of ‘concerned shareholders’ who respond to unexpected developments, then two-thirds of activists who made public demands last year were shareholders simply deciding to take a stand on a particular issue.

Regular monitoring by the company of its register, down to the smallest holdings, is an obvious way to stay abreast of emerging activist activity. It needs to be a thorough analysis, overlaid with information of the activist’s past behaviour so that conversations with them can recognise the prospect of their true agenda.

Alex Waislitz’s Thorney Opportunities Fund (TOP) is an activist fund which takes positions in companies ‘and pushes for positive change’, often behind the scenes. Money 3’s former Managing Director should have known there was a problem when TOP first appeared on his register in April 2014 with just over 1%. Fifteen months later he was removed by the board following a strategic review, resulting in a decision (which he strongly opposed) to transition away from its core business. TOP was also instrumental in ensuring the Chairman of Austin Engineering did not stand for re-election in November 2015, following an extended period of underperformance. In the months following the AGM, the entire leadership team was also restructured.

Focus on Boards and Governance

Half of activist activity in 2015 was focused on Board related activism, mainly lobbying for board positions and removing incumbents[3]. Fund manager, Allan Gray is perhaps most well-known for speaking out when companies lose their way. The late Simon Marais, Head of Equities at Allan Gray, was particularly scathing of the board selection process.

In an interview with the AFR[4] in 2013 he said, “There’s no competitive tension for board seats. I think if they have six positions they should nominate 10 or 20 people and then you vote for them. We’ve tried to put a few people on boards and it’s inordinately difficult; even when we are big shareholders the chairman just doesn’t want to do it – and that’s that!”

Major shareholders in ASX-listed Bionomics are currently agitating for the replacement of two directors, including the Chairman, with two shareholder representatives on the board. This follows the current Board’s move in late 2015 to implement a highly dilutive placement to four US institutions, preceding a 40% collapse in the share price.

Activists take the lead in Investor Communications

Activists’ tactics used in the US and Europe are increasingly being deployed here.

One example is the circulation of a detailed forensic analysis of the company’s performance to prosecute their case with institutions, brokers and the media. That is, the activist shareholder is often challenging the company’s own articulation of its strategy or providing an alternative view on the valuation of a stock to that commonly prosecuted by broking analysts.

We saw this tactic used to devastating effect in 2015 with VGI Partner’s analysis of Slater and Gordon’s accounting practices; in February 2016 when Sandon Capital released a detailed presentation on Tatts Group, arguing for a demerger; and in March 2016 with activist, James Dunphy, launching a campaign to spill the Spark Infrastructure board, which included a detailed presentation pack and also, unusually (for Australia), a single issue website.

Notably, institutional investors are willing to let activists take the running to push for change. A report released last year[5] showed that 76% of surveyed institutions had a favourable view of shareholder activism and that 84% thought that it added value to targeted companies.

Is Australia the next Opportunity for Foreign Activists?

While activism in Australia is still in its infancy, the significant amounts of money building in specialist activist funds globally mean that the activist trend is moving beyond US shores. Australia is now among the most-cited non-US jurisdictions for future shareholder activism.

Australia also stands apart as having one the lowest rates of foreign activism[6] at only 18% compared with 40-65% across the UK, Canada, Asia and Europe, highlighting why it might be viewed as an attractive market for activist capital.

There is no standard profile for an activist target but underperformance for an extended period of time or an unexpected event that has adversely impacted the share price, will make a company particularly vulnerable. It does not help if management are seen to be uninterested in, or unresponsive to, shareholder concerns despite persistent efforts to engage with them. So the signs are often there, but ignored.

There is a general consensus among activists that 2016 will be the year when institutional investors move from being supporters of activism to partnering with them. So companies need to be aware that they can no longer assume that their institutional shareholder base is their ally as this group of investors becomes increasingly comfortable with taking, or supporting, an activist stance.

[1] “Hedge Funds and Unsolicited Bids”: The Activist Annual Review 2016

[2] Activist Insight is a UK based information provider on shareholder activism globally

[3] Activist Investor: Activist Investing Annual Review

[4] The Australian Financial Review 28 August 2013: “Activist Investors who really mean business”

[5] 2015 Shareholder Activist Landscape: An Institutional Investor Perspective, FTI Consulting, January 2015

[6] Activist Investor: Activist Investing Annual Review

Originally published in Listed@ASX magazine