VICTORIA GEDDES, Executive Director

Over the past four months we have monitored companies in the ASX 300 Index reporting their full year results. Around 70% of companies in the S&P/ASX 300 index released their results for FY23 during August 2023.

Companies return to providing guidance

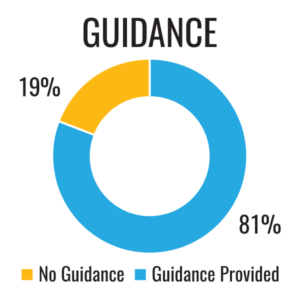

The majority of companies (81%) reporting their full year results this year gave some form of guidance which represents a major increase from our observations in August 2022 (53%).

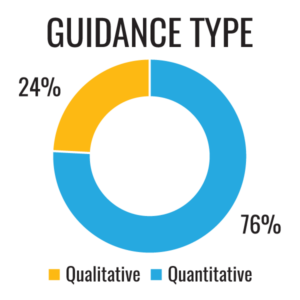

Of the companies that gave guidance, 76% chose to do so quantitatively which was slightly higher than August 2022 (74%). The remaining 24% provided qualitative guidance (26% at August 2022).

Differences between Sectors

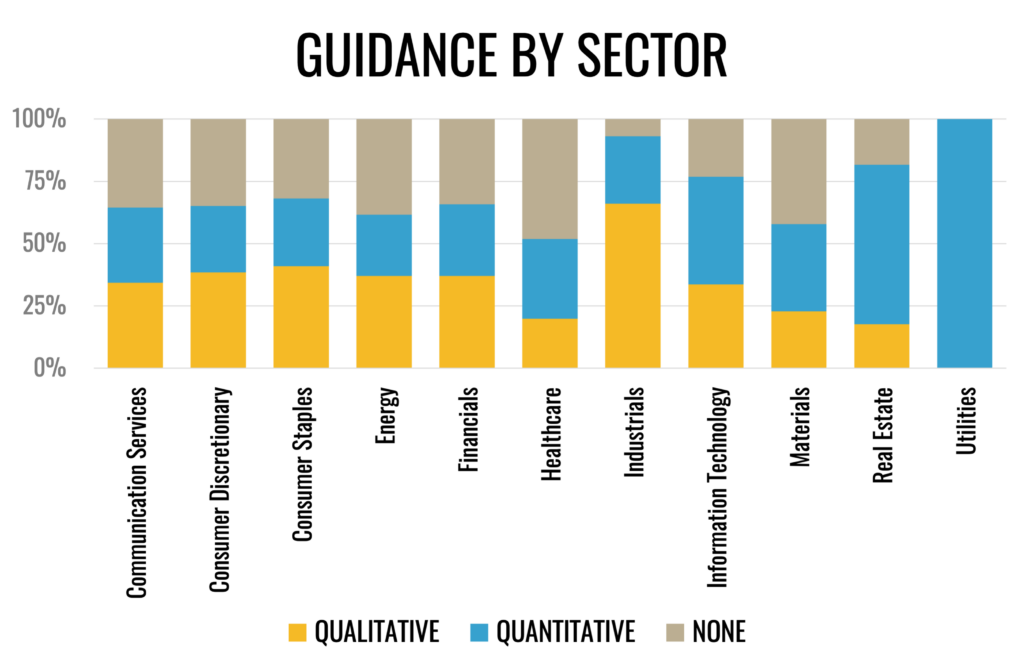

The four sectors that were most forthcoming with guidance were Utilities (100%), Industrials (93%), Real Estate (81%) and Information Technology (76%). This contrasts with last year when Real Estate (90%), Communication Services (79%), Industrials (77%) and Materials (74%) topped the list.

In the Healthcare sector 49% of companies elected not to provide any guidance, an improvement on 60% last year, whereas, in the Materials sector 42% of companies elected not to provide any guidance, more than the 28% last year. In the Consumer Discretionary, Consumer Staples, Communication Services, Energy and Financials sectors 30-40% of stocks also avoided providing guidance, a significant improvement from last year’s (40-50%).

Looking at those sectors that favoured providing quantitative feedback, companies in the Utilities (100%), Real Estate (64%) and Materials (42%) sectors stood out. With the exception of Utilities, this is lower than last years’ experience of Real Estate (78%), Materials, and Industrials (both 60%).

Industrial companies reported the highest qualitative guidance (65%), a marked contrast to the 15% last year. The Consumer Discretionary and Consumer Staples sectors both continued to favour qualitative guidance (38-41%) compared to last year (30-40%). They were joined by Communication Services, Energy, Financials and Information Technology (c.35%), an increase on last year (10-20%).

Guidance by Index

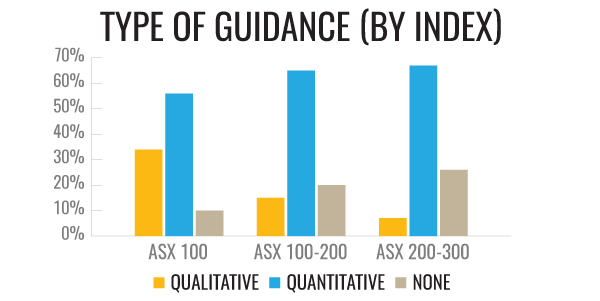

Over 60% of companies outside the ASX 100 provided quantitative guidance compared to 55% in the ASX 100 which was also the sector most likely (34%) to favour qualitative guidance. The smaller the company, however, the greater the tendency (20-25%) to not provide any guidance at all.

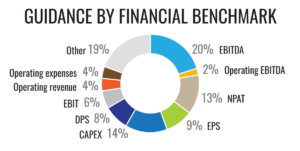

EBITDA was the preferred earnings guidance metric

While EBITDA/Operating EBITDA (22%) was the preferred metric, 44% of the companies that provided earnings guidance, focused on EBITDA, NPAT or EPS.

Not all guidance was earnings related with Capital Expenditure (14%) the most commonly provided alternative, typically by companies in the Materials sector.

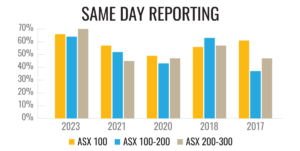

Same Day Reporting exceeds pre-Covid levels

We have been tracking the trend for listed companies to publish their full, ‘glossy’ annual report on the same day that they release their results since 2017. At that time, while 60% of companies in the ASX 100 had made the leap, less than half of those in the ASX 100-300 were on board, particularly companies in the ASX 100-200 (37%).

After what would appear to be a Covid-related relapse in 2020 and 2021 all companies, regardless of size, are now firmly back on track to delivering this popular KPI. This year 71% of companies in the ASX 300 released their annual report on the same day as their results.