In July 2018, FIRST Advisers’ analysis of financial results reporting noted the continued trend by ASX 300 companies to publish their Annual Reports on the same day as their Financial Results. Termed ‘Same-Day’ or ‘Simultaneous’ reporting, we have updated our findings to see how ASX 300 companies with a June 30 balance date faired in achieving this new norm, following conclusion of the 2018 reporting season.

Same-Day reporting now in the majority

For the majority of ASX 300 companies, releasing the annual report on the same day as financial results is now the best practice standard in company reporting.

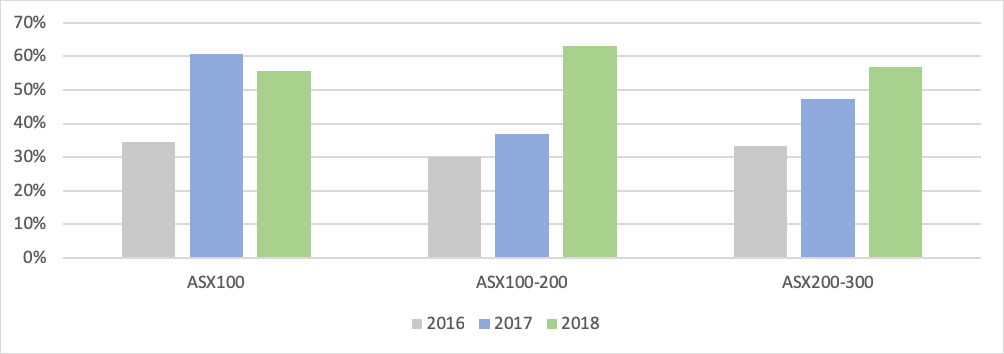

In 2018, the number of companies embracing ‘Same-Day reporting’ increased by approximately 15% to 58%, driven largely by mid-cap companies, and continuing a trend that has been prevalent for the last few years.

We first highlighted the trend amongst ASX 300 companies towards publishing annual reports on the day they announced full year results, ‘Same-Day Reporting’, in early 2017. Our analysis since that time indicates that this trend has persisted and has now become the best practice for publishing annual reports.

‘Same-Day reporting’ eliminates the information timing gap that can exist between institutional and retail investors, and ensures the Annual Report maintains relevance, rather than being a stale document at the time of its release.

Companies who adopt this practice are also reporting that ‘Same-Day’ reporting provides Boards, Senior Management and Investor Relations teams with greater room to focus on their post results roadshows, AGMs, and of course running their businesses, rather than logistics of report production.

CHART 1: COMPANIES RELEASING ANNUAL REPORTS ON THE SAME DAY AS FINANCIAL RESULTS

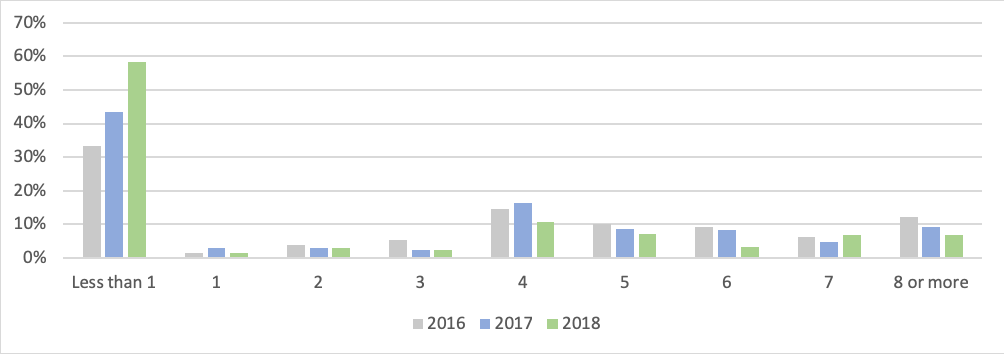

Notably, our analysis of the 2018 reporting season showed that Same-Day reporting by ASX 100 companies with a June 30 balance plateaued at around 56%. However, compared to 2017, there has been a significant uplift in mid-cap companies adopting Same-Day reporting, as shown in chart 2.

CHART 2: TREND TOWARDS “SAME-DAY REPORTING’ WITHIN THE ASX 300

Consistent with this trend, ASX 300 companies who have not adopted ‘Same-Day Reporting’ are publishing their annual reports sooner than in prior years.

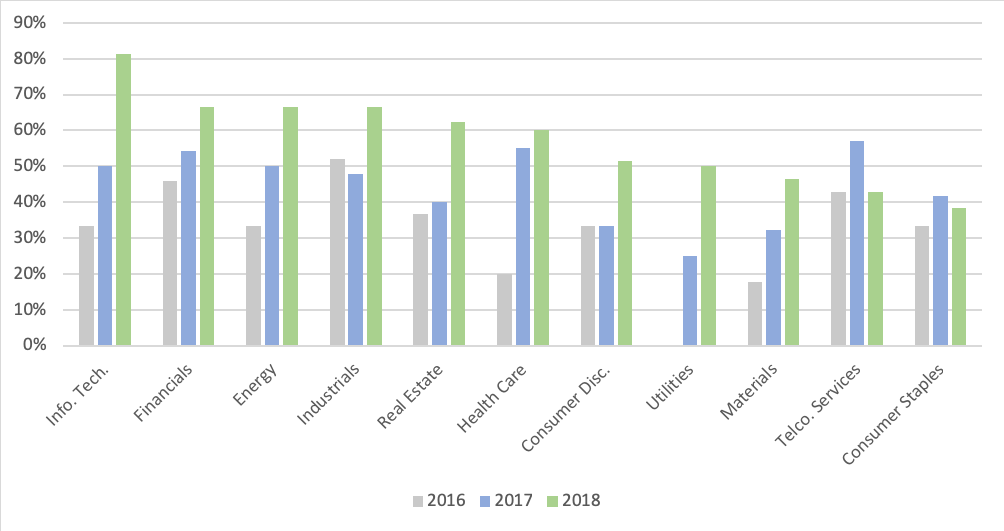

Over 75% of ASX 300 companies with 30 June balance dates released their annual report within one month of their financial results, up 8% on 2017 and 18% on 2016. (Chart 3)

CHART 3: NUMBER OF WEEKS BETWEEN FINANCIAL RESULTS AND ANNUAL REPORT

As has been the case in prior years, the next two most prevalent periods for publishing the annual report for ASX300 companies are the 4thand 8thweeks post the results announcement. These weeks often coincide with dispatch of those companies’ Notices of Annual General Meeting. While in prior years, approximately one quarter of ASX 300 companies released their annual reports in these two week periods, this proportion has now fallen to 17%.

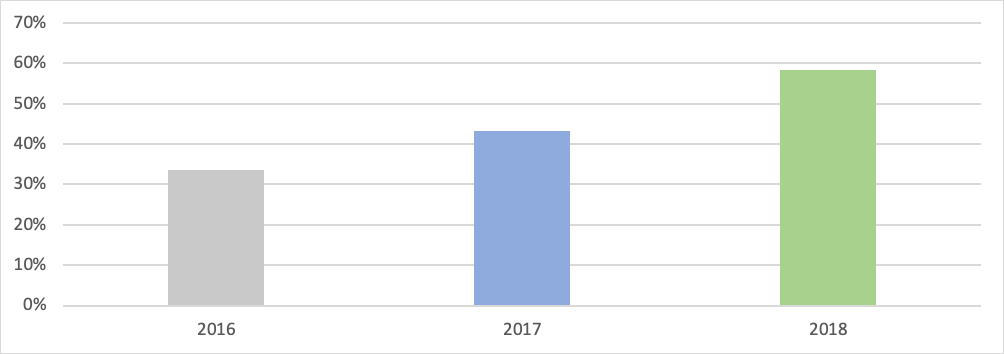

Our analysis also shows that ‘Same-Day reporting’ has been adopted across the majority of sectors. Only in the Materials, Telecommunication Services and Consumer Staples sectors, do the majority of companies continue to release their Annual Report after their financial results announcement. And only the Telecommunication Services and Consumer Staples sectors experienced a decline in Same Day reporting in 2018. (CHART 4)

CHART 4: ‘SAME-DAY REPORTING – SECTOR BREAKDOWN

The Information Technology sector experienced the biggest shift towards ‘Same-Day Reporting’ in 2018, with over 80% of ASX 300 companies in that sector achieving the new benchmark.

From the 2018 reporting season, releasing the annual report on the same day as financial results is now the new standard in company reporting. It is facilitated by advances in publishing and content creation technologies and delivers significant efficiency gains by allowing Boards, Senior Management and Investor Relations teams to focus on the post results roadshow, AGMs and their businesses. Same-Day reporting also allows companies to present a more complete and consistent investment case to the market at a time when investors are looking their way.

With the compression of reporting timetables offering significant benefits to investors and improved efficiency for companies, we are now asking ourselves, will September AGM’s become the next Investor Relations benchmark to pursue?