Dan Jones, Manager Shareholder Analytics

During August we monitored all companies in the S&P/ASX300 Index that reported for the period ending 30 June 2018, building a picture of the approach to guidance in this market and what that guidance is telling us about outlook.

Almost 250 companies within the S&P/ASX 300 index gave their results during August, with large companies particularly well represented. All but four of the S&P/ASX 20 (ANZ, NAB, WBC and MQG) and 82 of the S&P/ASX100 reported during the month.

*Note: guidance for December Year end companies (i.e. those reporting half year results in August) refers to expected FY18 result. Guidance for June-Year End companies refers to expected FY19 Result, unless otherwise stated.

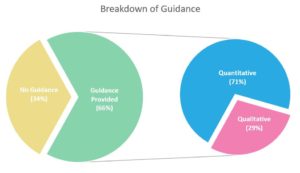

The majority of companies provide guidance

Two thirds of companies which reported in August 2018 gave some form of guidance down from 74% in February 2018. Of guidance provided, the majority is given quantitatively.

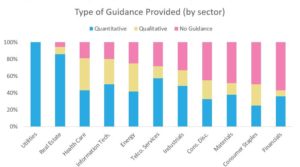

Differences between Sectors

By sector, Industrials and Real Estate (includes REITS) saw the largest proportion of their sector constituents reporting over the month (96% and 95%, respectively). By contrast, the least represented sectors during August were Materials (71% of constituents reported) and Consumer Staples (76%).

All Utilities Sector companies provided guidance over the period, however 40% of this came as quantitative guidance related to performance rather than a financial metric. Real Estate companies were the next most forthcoming with guidance (94%), followed by Healthcare (81%) and Information Technology (80%). At least half of reporting companies in the Materials and Financials sectors did not give any forward looking guidance.

Quantitative feedback was most common for Utilities (100% of guidance provided) and Real Estate (86%) companies. The Consumer Sectors lagged in this regard, with just 25% of Consumer Staples and 33% of Consumer Discretionary companies providing quantitative guidance.

Despite another decline, outlook remains overwhelmingly positive

84% of companies providing guidance expected their next full year result to be equal to or above their most recent. This was down from 87% in February 2018, and 93 % in August 2017.

Consistent with previous analysis, the companies in sectors which provided proportionally more guidance tended to be more optimistic about the future. The Healthcare and Utilities Sector were amongst the most prolific providers of guidance and did not have a single constituent which reported a declining outlook.

Unchanged from February, the sector with the most pessimistic outlook was Telecommunications Services where more than half of companies expect a decline in earnings, while between 20-25% of Financials, Energy and Information Technology companies are forecasting a decline.

When comparing the guidance provided in August to February, Energy and Healthcare sectors showed the most improvement, while Information Technology, Real Estate and Materials experienced the largest negative changes.

The only S&P/ASX 20 Company expecting a decline in FY19 was Telstra, which had previously flagged difficulties as part of a market update in June 2018.

EBITDA and NPAT were the preferred financial guidance metric (40%)

Of companies providing financial guidance, 51% came in the form of EBITDA , NPAT or EBIT down from February’s figure of 55%.

All companies in the Energy, Materials and Telecommunications Service that chose to use a financial metric to give guidance did so with EBIT, EBITDA or NPAT. Other sectors that provide the majority of guidance using these metrics were Consumer Discretionary (83%), Healthcare (73%), Utilities (63%), Consumer Staples (50%) and Information Technology (50%).

Only 10% of Real Estate companies (largely REITs) chose to use one of these three metrics, instead preferring to use DPS (Dividend Per Share) or FFO (Funds From Operations).

Not all guidance was given using a financial metric

There was an increase in the number of companies giving guidance using non-financial metrics, i.e. performance metrics, such as total production or ‘operational results’ (20% of guidance provided).

The largest providers of non-financial related guidance were the Materials sector, with 68% of the guidance provided being non-financial, and the Energy Sectors, with 67%.

Non-Financial guidance was often qualitative, e.g.

‘Directors anticipate FY19 will show a continuing improvement in operational results.’

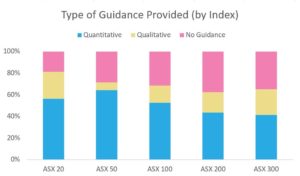

Larger companies gave qualitative guidance

In line with our observations from the February Reporting Season, constituents of the S&P/ASX 20 gave qualitative guidance more than Ex-20 companies, and also tended to give outlook on a segment by segment basis. This is likely reflective of their relatively complex structures.

Note: Each company is counted only in its ‘top’ index

Qualitative guidance needs to add value

Qualitative guidance adds the most value when it clearly gives a clear indication of expectations or dives details of external factors that may impact on earnings. In a continuation of a previously observed trend, however, much of the qualitative feedback provided during the August reporting season was non-specific, giving only a general overview of expectations.

In some instances, qualitative guidance was limited to an overview of sentiment at Board and senior management level, e.g.

‘The Board shares my confidence in our ability to continue to deliver sales and profit growth in the coming year.’

or broad statements around short term earnings, e.g

‘FY19 underling profit will continue to reflect ongoing input-cost inflation and other cost challenges. Operational initiatives expected to progressively deliver efficiencies and earnings benefits over the medium term.’

High level qualitative guidance that references sentiment and broader macro-economic impacts on a company’s performance may need to be supported with guidance on specific financial or performance metrics if it is to make a meaningful contribution to an investor’s decision making process.